Why Refinance: 6 Reasons to Refinance in the Malaysia

Most property owners are likely conscious that to buy a house is the most significant investment might actually ever build. For this reason you ought to comment your residence mortgage out-of big date in order to day. But, you may be curious, as to why re-finance your existing home loan?

Which have altering lifetime affairs and security accumulated, you might refinance so you’re able to financing with better conditions to fulfill your current otherwise future need. When you are nevertheless undecided regarding the refinancing, read on to understand the way it operates in addition to popular explanations having refinancing.

Why payday loans Sheridan Lake, CO does Refinancing Work?

Once you refinance your house loan, you are basically closing away from your loan and you may replacing they with a new one to. It certainly is done to get better interest rates otherwise terms and conditions.

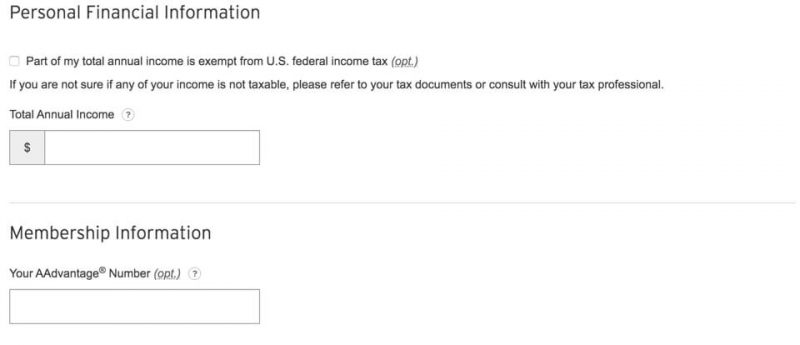

The entire techniques is a lot like getting the original home loan, where you are needed to promote your very own facts, economic advice or any other records.

Because the processing and you can recognition may take from a number of months so you can months, you really need to package and to change the schedule correctly.

Main reasons to help you Re-finance Your property Mortgage

There are a few advantages to refinancing your property. According to certain monetary needs, latest family really worth and you may potential with new home loan possibilities, below are a few of one’s reasons somebody desire refinance.

step 1. Make the most of straight down interest levels

If you qualify for a lowered rate of interest than you are paying, you’ll save a significant contribution along side longevity of new mortgage.

The interest cost to possess mortgage brokers often vary. Because of the securing a lesser interest, you could reduce your monthly repayment count.

Otherwise, you could use the other currency and then make larger money so you’re able to accept your property loan shorter and you will save yourself more about the total appeal will cost you.

2. Beat financial period

If the financial situation lets, you might reduce the loan tenure and you may pay your loan quicker. Generally speaking, reducing their financial period will increase your own month-to-month instalments.

Which have a smaller period, financially secure some body may out of financial obligation reduced and you may save yourself reasonable money from full interest reduced.

However,, people also have the ability to re-finance to another loan that have a smaller label and nearly the same month-to-month costs should the Ft Rates (BR) or Base Lending Speed (BLR) fall.

3. Stretch financial tenure

Property owners facing financial hardships while in the unexpected lives incidents (elizabeth.grams. health conditions, less money, the latest cherished one, etc.) normally readjust their monthly financing instalments predicated on their value.

Although not, this increases the total price of our home loan because you will end up being spending money on attract stretched.

4. Combine your financial situation

One other reason why refinancing might be an intelligent economic circulate was debt consolidation reduction. People overloaded by the numerous loans and you may credit cards can express the bills less than just one roof by refinancing.

As an example, you can consolidate expenses less than a different sort of mortgage by refinancing. With this, you no longer need to worry about while making several money in order to other loan providers and different interest levels. Check out types of expense you can consolidate from the refinancing:

- Credit card debt

- Unsecured loan (relationship to Consumer loan Malaysia’ blog post)

- High-notice expenses

- Medical charge

- Bankruptcy proceeding

- AKPK status

5. Change to more financing type

There is a lot more in order to home loans than getting property and you can interest levels. Particular consumers get decide to re-finance and change to yet another property mortgage method of altogether.

In doing this, you have access to new features of new home loan choices in the business. Designed to help save you towards focus and you will repay your loan at some point, refinancing can help you to: