What is the Minimum Credit score to possess an effective Va Mortgage?

Think of our creating team such as your Yoda, that have expert loans pointers you can rely on. MoneyTips shows you maxims just, as opposed to bells and whistles otherwise foregone conclusion, to help you real time your very best monetary existence.

Explore Their Mortgage Options

The brand new Va doesn’t mandate at least credit history having people. Yet not, its rules requires that lenders comment an enthusiastic applicant’s entire loan profile. Ultimately, this permits loan providers setting her credit history limitations, as long as they still comment everything you. Such as for example, Rocket Mortgage requires that people getting Va financing has at the very least an excellent 580 FICO Score.

You are not alone when you are unclear about as to why loan providers features more minimums. Theoretically, the Va pledges mortgage loans from the Virtual assistant mortgage system, but it doesn’t situation them. Loan providers still have to decide for on their own when they likely to question the mortgage or perhaps not.

Mortgage brokers make one to decision predicated on an enthusiastic applicant’s risk character to phrase it differently, how almost certainly they feel the person would be to pay the borrowed funds. Credit rating is a big element of you to calculation.

Of the promising an element of the financing, brand new Va decreases a number of the lender’s risk, allowing them to deal with apps with down credit ratings than just it create getting antique financing.

Do you score a beneficial Virtual assistant financing that have poor credit?

In the event the credit rating is significantly less than 580, you’ll be much better off looking for ways to replace your credit score in the place of interested in a loan provider happy to accept your loan.

The reduced your credit score is actually, the higher the eye prices you are purchasing. This may charge a fee thousands of dollars along side life of the mortgage. You additionally work on increased likelihood of dropping sufferer so you’re able to financial scams.

Virtual assistant Mortgage Credit Babson Park loans Requirements compared to. Other Mortgages

So it desk shows how Va borrowing requirements accumulate against other sort of mortgages. For ease, we utilized the 580 score out-of Rocket Financial.

You might see that with a keen FHA loan, one may be considered that have a credit score as low as 500. However, you will need to assembled a good ten% deposit to do so.

Almost every other Virtual assistant Mortgage Eligibility Conditions

Even although you meet up with the credit score importance of a good Virtual assistant financing, there are some other standards just be aware of.

- Residence style of: Virtual assistant financing cannot be utilized for investment services or trips land. You need to thinking about making use of the household as your top house.

- Debt-to-money (DTI) ratio: Just like credit history, there aren’t any authoritative DTI proportion limits put from the Va. not, of several loan providers tend to place their unique restrictions within its exposure research.

- Virtual assistant financial support fee: This is a-one-big date percentage the mortgage candidate need certainly to generate towards the a Va financing. The point is to try to lessen the cost of the borrowed funds to own U.S. taxpayers. It usually selections between 1.5% and you can 3.3% of your own loan’s really worth.

Virtual assistant Financing Next Methods

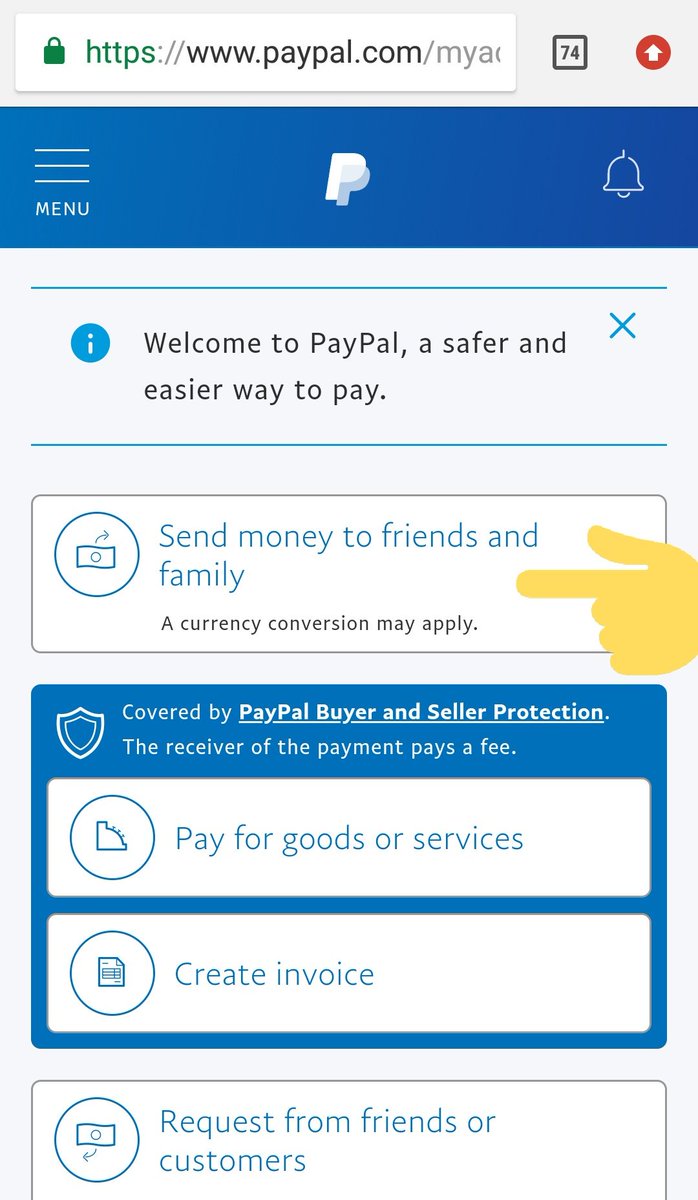

If you feel your meet the requirements and they are looking trying to get an excellent Virtual assistant financing, here are some ideal second procedures.

- Safer the certificate away from eligibility (COE): That it file commonly convince loan providers you are entitled to a good Va loan. You can either make an application for it file on the internet otherwise fill in Virtual assistant Setting twenty-six-1880 and complete it so you’re able to a community Virtual assistant processing center. Your own bank may also help be certain that your COE while you are having troubles finding they.

- Apply for preapproval: Work on their bank to acquire preapproved. This will let you know simply how much domestic you really can afford and you may improve your bargaining electricity.

- Start home browse: From this point, you’re advisable that you start to look to possess properties. After you choose one you love, you could fill in an offer that day. In case it is acknowledged, the loan will go to underwriting. Just in case it’s approved, you will be obvious to close off.

Faq’s regarding lowest credit score for Va finance

With a score that lower, you will probably has actually a difficult time wanting a professional lender ready so you can agree your own Virtual assistant loan. It’s also advisable to get on alert for scammers, and you can remember that even if you be able to safe that loan, you’ll probably shell out higher interest levels.

Instead, you happen to be best off enhancing your credit rating along the 2nd several months. This can opened way more loan providers to select from and you can save your money on focus.

Virtual assistant lenders should look for an enthusiastic applicant’s COE, hence demonstrates qualifications into system. They will certainly also review its DTI ratio and credit rating. The individuals thresholds are different regarding lender so you can bank, as Va cannot mandate minimums. Rather, this new Virtual assistant requires lenders to review the whole mortgage character.

For those who qualify for an excellent COE, Virtual assistant funds are simpler to be eligible for than simply antique finance, just like the there is absolutely no advance payment demands, and you may loan providers place their unique minimums regarding borrowing history and you can DTI proportion.

For Virtual assistant Fund, Loan providers Opinion the whole Loan Character

Even in the event minimum fico scores are not mandated by the Virtual assistant, you can nevertheless work with with a top credit rating. In most cases from thumb, the better your credit rating try, the greater amount of advantageous the loan words might possibly be.