The fresh new Detroit Family Restoration and you can Order Program

The new Versatility Bank Home Repairs and you can Order Program (HRAP) is a unique low-old-fashioned mortgage loan concerned about supporting the repair from society.

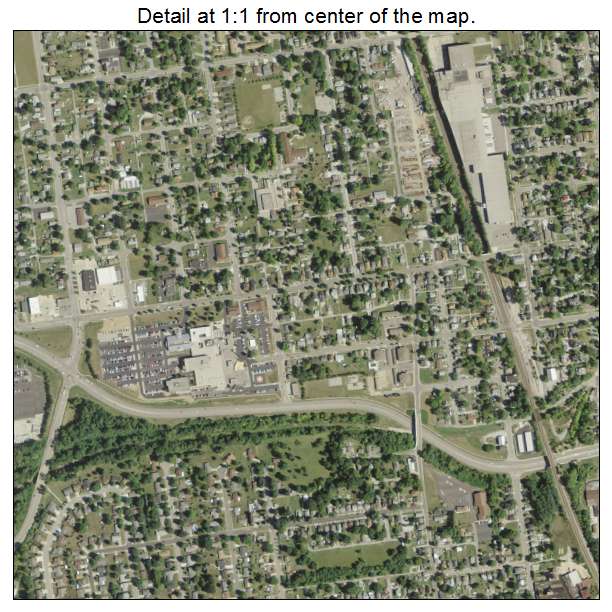

Our very own system into the Detroit, Michigan permits good homebuyer to finance the acquisition and people requisite fixes or home improvements to their domestic being purchased in the most challenging Struck Priority Communities in town out of Detroit.

What is the mortgage device and how does it works?

Your house Fix and you will Purchase Program is designed for the acquisition or repair from owner occupied property in town out-of Detroit. Having a property Fix and Purchase financing, a borrower will pay desire-just inside design or repair phase, and the loan often become a permanent home loan oriented into the final worth of the home. This may involve the brand new Detroit Land-bank on the internet auction. When a person is the brand new effective buyer from auction, he’s 24 hours to place down 10% of profitable quote. They then has actually 60 in order to 90 days to close off, and you will six months to complete people needed solutions or nine weeks getting residential property situated in appointed historic communities.

However, waiting, commonly appeal only loans bad?

The interest only loans try Whitesboro loans to have property which might be being ordered and refurbished. I would not strongly recommend notice simply financing for the majority family, in this situation it functions. Just like the belongings require repair, children may not be able to relocate straight away. By paying notice only for the fresh new months the house are undergoing fix, a household normally prevent buying a few residential property at the same time.

In which perform We initiate? How to implement?

Interested consumers should begin of the submitting new Query Mode at the base on the webpage. One of the agents will name you to definitely respond to people questions and commence the application process to you. Likewise, any of the three casing counseling communities in your geographical area already or in your local the place you intend to move have a tendency to help you. Brand new financial member or therapist will give an overview of the fresh new program and help potential individuals determine the amount of mortgage they can afford.

How can i make an application for down payment guidelines?

Down-payment help of doing $15,000 can be obtained in order to homeowners who meet the requirements. If the buy was on the Town of Detroit Land bank public auction homeowners must set 10% down on its profitable auction quote. The purpose of the assistance will be to link a space anywhere between the cost of repairs while the appraised property value our home. Detroit Public school group may qualify for around $20,000 inside off-commission guidelines.

What makes property guidance needed?

The house Fix and you will Acquisition System are a low-traditional financial and is vital you to homeowners see the device he is bringing. Property guidance is a vital investment to guarantee the debtor is ready to consider the risks and you can perks out of homeownership. Studies have shown one family one to discovered property guidance much more probably knowing its mortgage commitments.

Sure, While to find a property within the areas complete with the North-end, Boston Edison, Jefferson Chalmers, Southwest, Grandmont Rosedale, University Section, Marygrove, Bagley , Morningside, Eastern English Town and you can Foundation areas. On top of that, you can expect mortgages which aren’t part of House Repair and you will Buy Program.

I watched JPMC’s title from the program. How are they with it?

JPMorgan Pursue Foundation generated a non-profit contribution to any or all of one’s nonprofit couples on it, along with Liberty Financial, Detroit Land-bank Expert, Main Detroit Christian, Southwestern Economic Choice, and you may You-SNAP-BAC. JPMorgan Pursue Foundation is actually involved in intimate cooperation on the people to ensure the program’s success.

- Private Financial Domestic

- Examining Levels

Loan recommendations exhibited on the website off Freedom Lender is actually conformity on Federal Set-aside Insights for the Financing Act (12CFR226). Rates of interest demonstrated to have mortgage items are according to a yearly Commission Price (APR) that can fluctuate anytime.

Deposit pointers displayed on the internet site out-of Versatility Bank is during accordance towards Government Reserves Information for the Savings Work (12CFR230). Interest rates presented for deposit goods are based on Annual Commission Produce (APY) and may change anytime.