Closing costs: What they’re as well as how Far It Prices

Investopedia contributors come from various experiences, as well as over twenty five years there are tens and thousands of specialist editors and you may editors who possess shared.

Preciselywhat are Settlement costs?

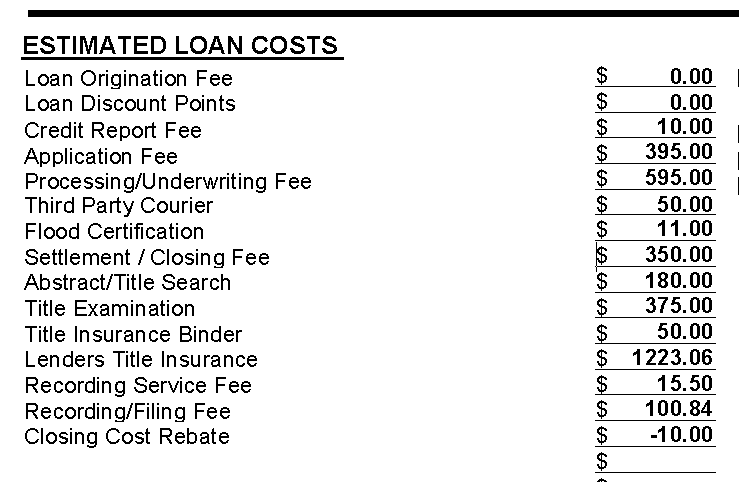

Closing costs would be the expenditures in addition to the brand new property’s price that consumers and you can vendors bear to-do a genuine property transaction. These types of can cost you start around financing origination fees, write off situations, assessment charge, identity lookups, name insurance policies, studies, taxes, action tape charges, and you may credit history costs. By-law, loan providers must bring people which have a closing disclosure around three working days before a booked closing, or payment, big date.

Secret Takeaways

- Settlement costs was costs due at the closure of a genuine estate deal as well as the property’s purchase price.

- Each other customers and providers tends to be susceptible to settlement costs.

- Examples of closing costs is costs related to brand new origination and you may underwriting out-of a mortgage, home profits, fees, insurance coverage, and checklist processing.

- Settlement costs must be unveiled by-law to help you customers and you will suppliers and arranged just before personal loan companies Riverside MO a bona fide property package is complete.

Exactly how much Was Settlement costs?

Closing costs exist when the assets identity is actually transferred in the provider on the customer. This new closing costs may differ because of the place and you may confidence this new value of. Homeowners generally speaking pay between step three% and you will six% of the cost to summarize will cost you. Home financing off $three hundred,000 will surely cost everything $9,000 so you can $18,000 on payment.

The fresh new nationwide mediocre closing costs getting just one-relatives property in the 2021 were $6,905 with import taxation and you can $step 3,860 leaving out taxation, considering a survey of the ClosingCorp, a nationwide company specializing in such will cost you. By the state, the highest settlement costs incurred from the part of the sales price was basically regarding the District of Columbia at step 3.9%. Missouri ranked lowest for the costs during the 0.8%.

In government A residential property Settlement Measures Act (RESPA), the lending company must also bring a closing disclosure declaration discussing most of the closing costs.

People spend every settlement costs inside the a bona-fide estate purchase, but buyers can also be negotiate that have a provider to assist coverage closing costs.

Exactly what do Closing costs Tend to be?

- Software Percentage: Commission charged by lender so you’re able to processes a mortgage app.

- Attorneys Payment: A fee is necessary in a number of states and charged of the an effective a home lawyer to arrange and you may opinion home pick preparations and deals.

- Closure Fee: Labeled as a keen escrow payment, this will be paid down toward closing organization.

- Courier Fee: Covered new transport off paper documents.

- Credit history Fee: A charge to get credit history regarding around three biggest credit bureaus.

With regards to the variety of home loan or property, additional closing costs cover anything from FHA financial insurance coverage, a good Va mortgage commission, otherwise a homeowners connection (HOA) import percentage. One another FHA and you may Virtual assistant loans affect accredited consumers. Home owners associations are commonly included in condominium or flat organizations.

Can you Discuss Closing costs?

Certain settlement costs can be flexible. When the a buyer suspects a lender was incorporating a lot of costs, capable inquire about a reduction otherwise clarification. Buyers will likely be careful of too much control and you will documentation costs and you can is able to eradicate settlement costs from the:

Whom Will pay an excellent Realtor’s Payment from the Closure?

A house profits portray one of many large can cost you at the an excellent normal closure. Customers cannot shell out so it payment, sellers do. Generally speaking, the newest payment try 5% to 6% of one’s residence’s cost, and it’s split up equally between your seller’s agent together with client’s broker.

No-closing-cost mortgages beat of several not all costs to the buyer in the closing. Such mortgage loans can be helpful for a while in the event that quick to your dollars, nonetheless they constantly include large interest levels. Loan providers also can give in order to move settlement costs to the home loan, but that means consumers owe on the borrowed funds and also have to expend desire towards those individuals closing costs through the years.

Can-closing Will cost you Go from this new Imagine Time on Settlement Time?

Buyers would be to review the original financing guess carefully. If a lender can’t define a charge or forces back when queried, it can be a red flag. It is not unusual getting closing costs to help you change of preapproval to closing, however, big leaps or shocking additions need analysis.

The bottom line

Settlement costs is various charges due in the closing or settlement out of a bona fide property purchase. Buyers are responsible for the costs, including this new origination and you may underwriting away from a home loan, taxes, insurance rates, and you can checklist submitting. Settlement costs must be revealed by law to help you people and you will suppliers and you may decideded upon just before a genuine house package is performed.