An FHA mortgage try home financing supported by the brand new Federal Houses Administration

FHA mortgage

This type of financing is intended to own individuals with all the way down borrowing and/otherwise lower income, who require some extra help qualifying to possess a mortgage.

Since FHA secures these loans, home loan enterprises is also provide to consumers that have incomplete borrowing Cleveland savings and installment loan without taking on the excess exposure.

Therefore backing, you can buy an enthusiastic FHA financing that have a good FICO get regarding only 580. And you only need a good step three.5 percent advance payment.

Furthermore, FHA loan providers is actually a bit more flexible regarding the financial obligation-to-money ratio (DTI). So if you curently have loads of debt – maybe out-of student loans or car and truck loans – maybe you have an easier date qualifying getting a mortgage thru the latest FHA program.

FHA 203k loan

Including the FHA home loan program, FHA 203k funds is supported by the brand new Federal Construction Management. Nevertheless 203k financing was tailored so you can customers who wish to get an effective fixer-higher household.

Having a keen FHA 203k home loan, you could potentially fund your house purchase therefore the cost of repairs at the same time. So it departs you with just one, low-speed loan and just that payment per month – instead of purchasing property and you can taking out a separate financing to cover renovations.

The brand new 203k program has some of the same conditions since the a beneficial fundamental FHA financial. You just you desire step three.5 per cent off and you can an excellent 580 credit rating to meet the requirements in many cases.

Yet not, observe that the mortgage process will need a little longer because your financial must approve the latest restoration agreements and cost estimates when underwriting the loan.

Va mortgage

- Active-duty services professionals

- Experts

- Reservists

- National Guard users

- Enduring partners

Interest levels is actually reasonable, there’s absolutely no private home loan insurance (PMI), and greatest of all of the, there’s absolutely no deposit requisite. VA-qualified home buyers can purchase a home that have $0 off.

Merely note there’s a one-day resource commission required by brand new Va. This is exactly paid down initial otherwise folded into your loan harmony.

USDA mortgage

USDA money, particularly Virtual assistant fund, none of them people advance payment. They likewise have below-sector financial prices and you will reasonable home loan insurance policies.

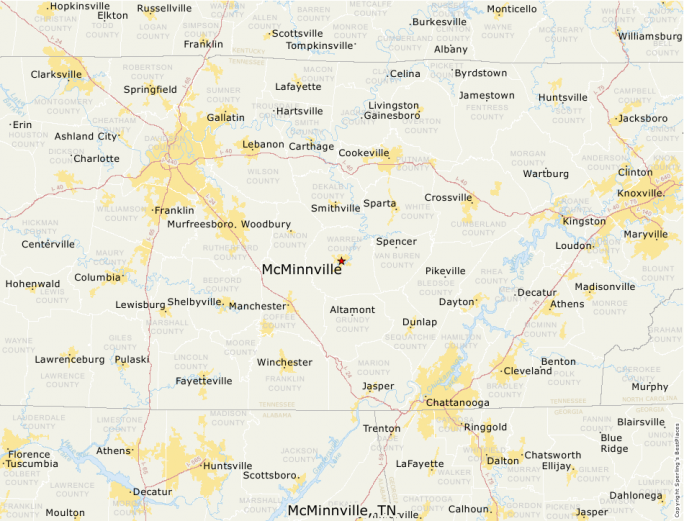

In order to be eligible for this choice, you must buy property for the a qualified outlying town. The fresh U.S. Service out-of Agriculture, which ensures USDA funds, decides and this areas be considered. Every U.S. landmass is eligible, excluding big metropolitan areas and heavily populated suburbs.

This new USDA and imposes income restrictions. Consumers are unable to create more than 115% of local average earnings within area.

Jumbo mortgage

Very home loans need to be inside compliant mortgage constraints lay from the Federal national mortgage association and Freddie Mac. Getting just one-home, those constraints maximum aside within $647,2 hundred inside the the majority of brand new You.S.

Just like the jumbo financing commonly controlled because of the Fannie and you can Freddie, lenders arrive at place its eligibility criteria. Really require a beneficial FICO get out-of 680-700 or maybe more at the very least ten-20% down payment. Yet not, low-down-commission jumbo funds come creating at the 5% regarding see loan providers.

5/step 1 Sleeve

An adjustable-rate financial (ARM) was a mortgage loan which have a changeable interest. The interest rate can often be fixed into the first few many years, after which it normally adjust immediately following per year with respect to the wide interest rate field.

A beneficial 5/step one Case has a whole financing identity from three decades, however your interest is repaired towards the basic five. Following, their price can alter a-year.

In the event that financial rates overall is actually ascending, their Arm rate might increase each year. Along with your monthly mortgage repayments manage increase, as well. That makes an arm much riskier for long-label homeowners than a predetermined-speed financial.