Getautotitleloans doesn’t have experience with or control over the mortgage conditions offered by a loan provider and you will lending lover

Lender’s or Financing Lover’s Revelation out of Conditions:- The lenders and you can lending people youre associated with offers documents containing most of the charge and you can price advice around the fresh loan to be had, along with any potential charge having later-costs plus the laws less than you could possibly getting greeting (if allowed of the appropriate law) in order to re-finance, renew otherwise rollover your loan. Loan fees and interest levels have decided exclusively by bank otherwise credit spouse based on the lender’s or lending lover’s inner policies, underwriting criteria, and you will appropriate legislation.

The minimum amount borrowed having a title Financing inside the Ca was $ten,600

Please be aware one shed a payment otherwise and come up with a later part of the payment can adversely effect your credit score. To guard your self and your credit rating, definitely only undertake financing terms that one can afford to settle. If you’re unable to build a cost on time, you ought to speak to your loan providers and lending couples instantly and you may discuss the way to handle late costs. Mortgage recognition as well as your amount borrowed depend on bank requirements regarding your credit, the condition of the car, along with your capability to create monthly obligations. You will be charged mortgage loan (APR) away from 32%-%, into the Ca and you may cost words range from 24 to help you forty eight days. Minimal loan amount is $2,501.

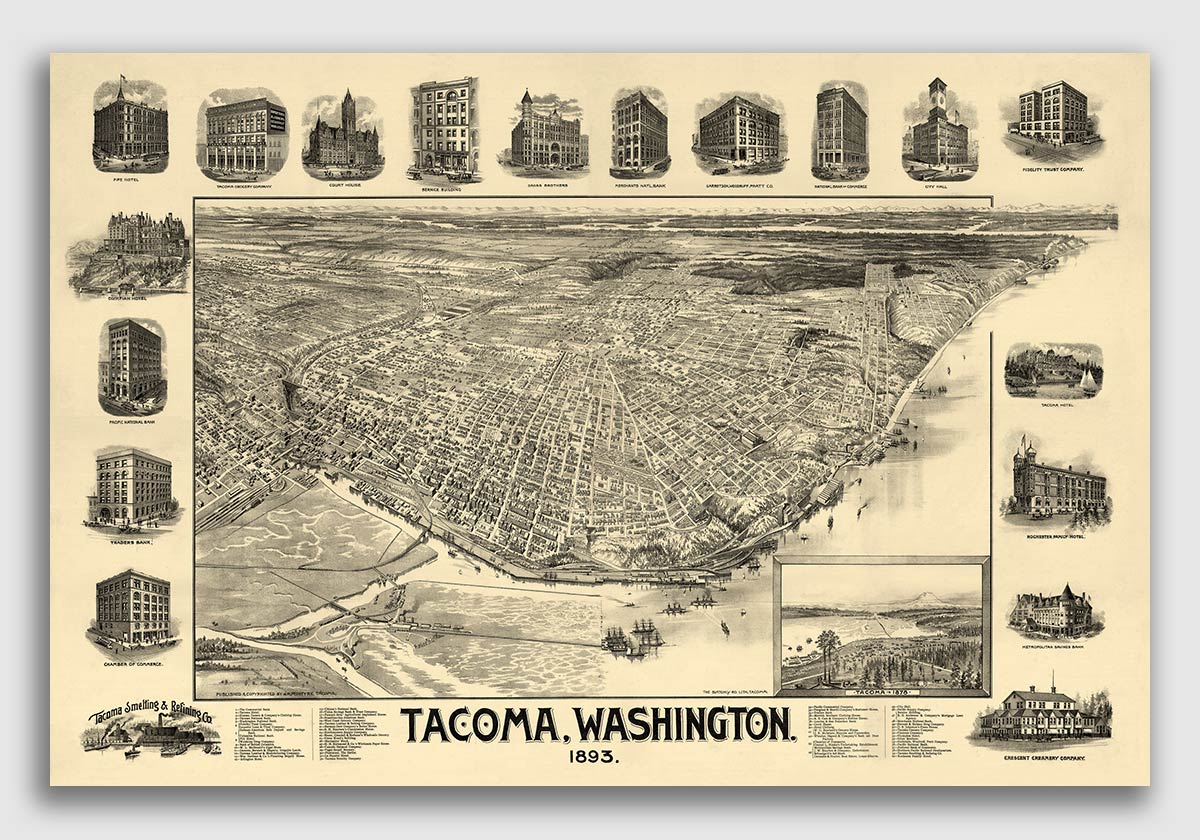

Candidates during the California may also be recharged an administrative commission one range of 2 so you’re able to 5% of the complete matter funded. These types of fund carry highest-interest levels, and you may a lender can repossess your car or truck for folks who get behind on your loan obligation. Make sure your bank are licensed because of the every requisite regulatory agencies. Ensure he’s a ca Finance Lenders Law License as needed by the Agencies from Financial Safeguards and you will Invention. The fresh chart and you can money suggestions revealed less than was an enthusiastic illustrative examples of your own total cost for a subject financing. The latest Apr less than try computed considering equivalent-duration cost symptoms. The loan applications are subject to fulfilling Lenders’ credit criteria, which include getting appropriate property given that security. Customers need to have indicated the ability to pay the loan. Never assume all individuals is recognized.

The applying procedure could take four (5) moments to accomplish. Through to conclusion, conditional acceptance tends to be considering pending review of paperwork. Financial support time will be based upon committed off latest recognition adopting the receipt and you may writeup on most of the needed data and you can finalizing, just before 5 PM PST towards the a business day. New Annual percentage rate (APR) are 32.9% having a repayment several months between 24 so you can forty-eight days. Like, financing out of $10,750 that includes an enthusiastic origination fee regarding $75, that have an annual percentage rate of thirty two.9% and you may an expression regarding 3 years, will result in a payment per month out-of $. dos An automated commission payday loan legality Oregon and you may interest rate protection arise for each times to a total desire protection price out-of 20%, if you’re your loan fits the following qualifications criteria: (1) the loan have to be lower than thirty days past due in the the minutes, (2) the mortgage don’t was indeed altered, (3) the car try not to were repossessed, and (4) the borrowed funds don’t reach their fresh maturity big date. If any moment the borrowed funds will not meet each of these qualifications requirements, the mortgage will no longer be eligible for any automatic fee and you may attract percentage point cures.

Late Money Damage Your credit score

United states PATRIOT Operate Notice: Information In the Starting A different sort of Account To help the federal government fight the latest money of terrorism and money laundering items, Government legislation demands the creditors to track down, be certain that, and you will listing recommendations that makes reference to differing people who opens an account. What this signifies to you: When you unlock a merchant account, we’ll require the label, address, time out of birth, and other advice that will allow me to pick your. We could possibly and additionally query observe your driver’s license and other distinguishing documents. By using a display reader and generally are having problems with this particular site, delight telephone call 951-465-7599 for advice.

By distribution your information via this amazing site, youre permitting Getautotitleloans as well as lovers doing a cards examine, that may were guaranteeing your own societal safeguards number, driver’s license amount, and other character, and you may a review of your own creditworthiness. Borrowing from the bank inspections usually are performed by one of the leading borrowing from the bank bureaus such as Experian, Equifax, and you can TransUnion, and in addition start around solution credit bureaus eg Teletrack, DP Agency, or others. you authorize Getautotitleloans to fairly share your information and you may credit history with a system off recognized lenders and you may credit people.