You are able to make use of these funds so you can raze a current house and build a unique you to definitely on the same base

Va recovery loan

Va loans was an advantage to armed forces services people and you will pros, offering the capacity to pick a home no down payment – and you may Virtual assistant recovery funds are no exception. Such finance succeed services members and pros to purchase property and you will funds the price of fixing it, to a hundred% of one’s expected property value your house just after recovery.

Just like any most other Va mortgage, you will need to prove that you meet the requirements through a certification out of qualifications in the You.S. Agencies out of Pros Circumstances (VA). On the other hand, there’s no minimal credit history – as an alternative, lenders usually opinion any financial photo to see if you are capable pay back the mortgage.

USDA repair financing

USDA financing allow somebody surviving in rural section to shop for an effective house and you may fund the price of renovations and you may repairs that have you to definitely loan closing. Zero advance payment is required; the borrowed funds is also funds as much as a hundred% of the requested value of the home just after its repaired upwards.

Financing continues are used for home improvements eg upgrading kitchens and you will bathrooms, accommodating the needs of those with disabilities, investing in a connection, while making structural transform otherwise setting up time-successful has. There aren’t any minimum resolve costs, although restrict is $thirty-five,100.

Issues should become aware of

You need to slip below the USDA’s money restrictions so you’re able to meet the requirements. There’s absolutely no minimal credit score, but you’ll need show you have enough money for pay-off the borrowed funds.

The veterans and armed forces payday loans can no longer process of to invest in a great fixer-upper is much like to order a timeless house, however, there are a few wrinkles. Here is how to maneuver forward.

step one. Do your research

Meticulously think about the different varieties of repair money offered and you may hence one(s) could work best in your role. Now is and a lot of fun to check on a few other lenders observe what offerings he’s got while the solution they offer.

2. Get preapproved for a financial loan

Really lenders allow you to complete an application on line so you’re able to be preapproved for a loan. You can influence the amount you’re likely to become able to obtain while the interest rate you might located.

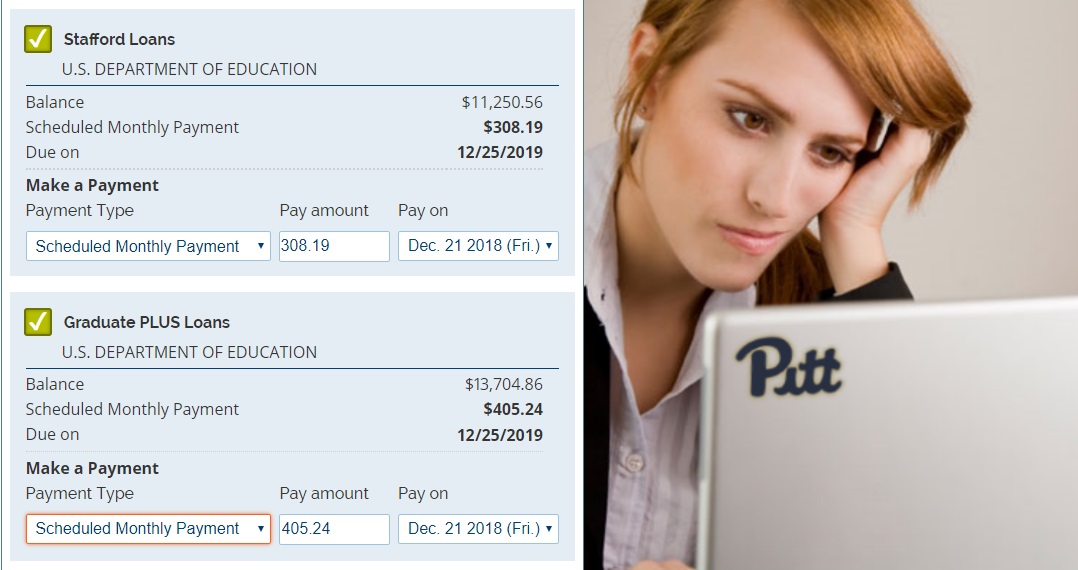

step three. Built a resources

Even though you might be acknowledged to possess a quantity cannot allow a good idea to acquire anywhere near this much. Check your monthly obligations and discover how big payment commonly fit easily in your finances. Don’t forget to reason for some extra, however if recovery can cost you exceed what you are planning.

cuatro. Search for a home

Knowing your finances, you can start home-hunting. You may also believe working with a realtor who will make it easier to select property that suit their conditions. They’re able to and likely help you figure out how much the latest house is likely to be really worth just after it’s repaired up.

5. Rating a home inspection

It’s always a good idea to hire a property inspector before to buy a house, but it is much more very important when you’re buying good fixer-higher. Domestic inspectors may help choose trouble spots that can need to be treated.

6. Build a remodelling bundle

Many res require that you build a homes plan ahead of being approved towards the mortgage. You’ll be able to get a builder who’ll walk the newest possessions within the homework months that assist determine the expense of doing brand new systems you have in mind.

eight. Get their fixer-higher financing

Once you’ve located an informed lender to suit your problem, picked a property and set along with her their repair bundle, you are willing to apply for your home loan. Once you have started preapproved, a loan manager should be able to assist guide you through the procedure. You will likely need to render far more files installation of your revenue and you may property to show you really can afford the mortgage.