Will it Sound right to utilize an unsecured loan to have a beneficial Cellular Home?

The expression, or length of time you have to pay off a consumer loan, is generally regarding two so you can five years. This will be much faster than the payment title to have a mortgage, and that’s several ages a lot of time. Because of this you will have less time to settle their unsecured loan, which will make your own monthly obligations large.

Rates

Unsecured signature loans might have large rates of interest than simply secured finance while there is no security into financial to grab when the your standard toward financing. Once the financial was taking up more chance because of the financing so you’re able to your that have an enthusiastic unsecured personal loan, they’re going to generally costs significantly more into the attract.

Additionally have likely in order to satisfy the absolute minimum money and you can credit score is accepted to own a personal loan. Certain lenders perform provide a consumer loan to own lower income , but these types of loan possess a top rate of interest.

Signature loans can be used for any type of mission, and resource a cellular domestic if not because the financing to possess home upgrade . That it flexibility ensures that to order a mobile house with an individual loan could make sense to you. Yet not, in case the are created household qualifies because the real property – definition they lies on the a charity, has no rims, and also you very own the property less than it – you may be better off together with other money alternatives.

Whether your mobile house suits the word property, you could potentially make an application for a home loan with some conventional mortgage programs, such as for example Federal national mortgage association otherwise Freddie Mac computer, otherwise service-recognized financial programs, like those from the Federal Houses Management (FHA), brand new U.S. Agencies out-of Experts Items, and/or U.S. Agencies off Farming.

A unique capital choice you could look for a cellular house is a good chattel loan. This really is a type of individual assets mortgage that may be utilized for movable assets, such as for instance when the mobile residence is based in a made household area and you rent the house or property the cellular is found on. The loan doesn’t come with brand new land, so that the closing process is easier and less costly than it is with a normal home mortgage. However, chattel financing are typically to own lower amounts of money than just mortgages are, and they’ve got reduced repayment terms and conditions. Meaning the eye cost on the chattel financing are often high, that will end in large month-to-month loan payments.

Bringing a personal loan having a mobile Home

If you’ve decided a personal loan is the best selection for your own mobile domestic pick, you will find several stages in the process. Some tips about what doing.

1pare Loan providers

When shopping for a personal loan to have a cellular domestic, you will want to contrast loan providers to see just what rates and you can terminology they you’ll provide. You could discuss possibilities out-of financial institutions and you will borrowing from the bank unions, plus men and women away from on the internet lenders. When deciding on an on-line lender, beware of people warning flags you to definitely laws the lending company may well not become reputable. Watch out for such things as impractical promises, inaccuracies on the mortgage fine print, and you may asks for initial software charge.

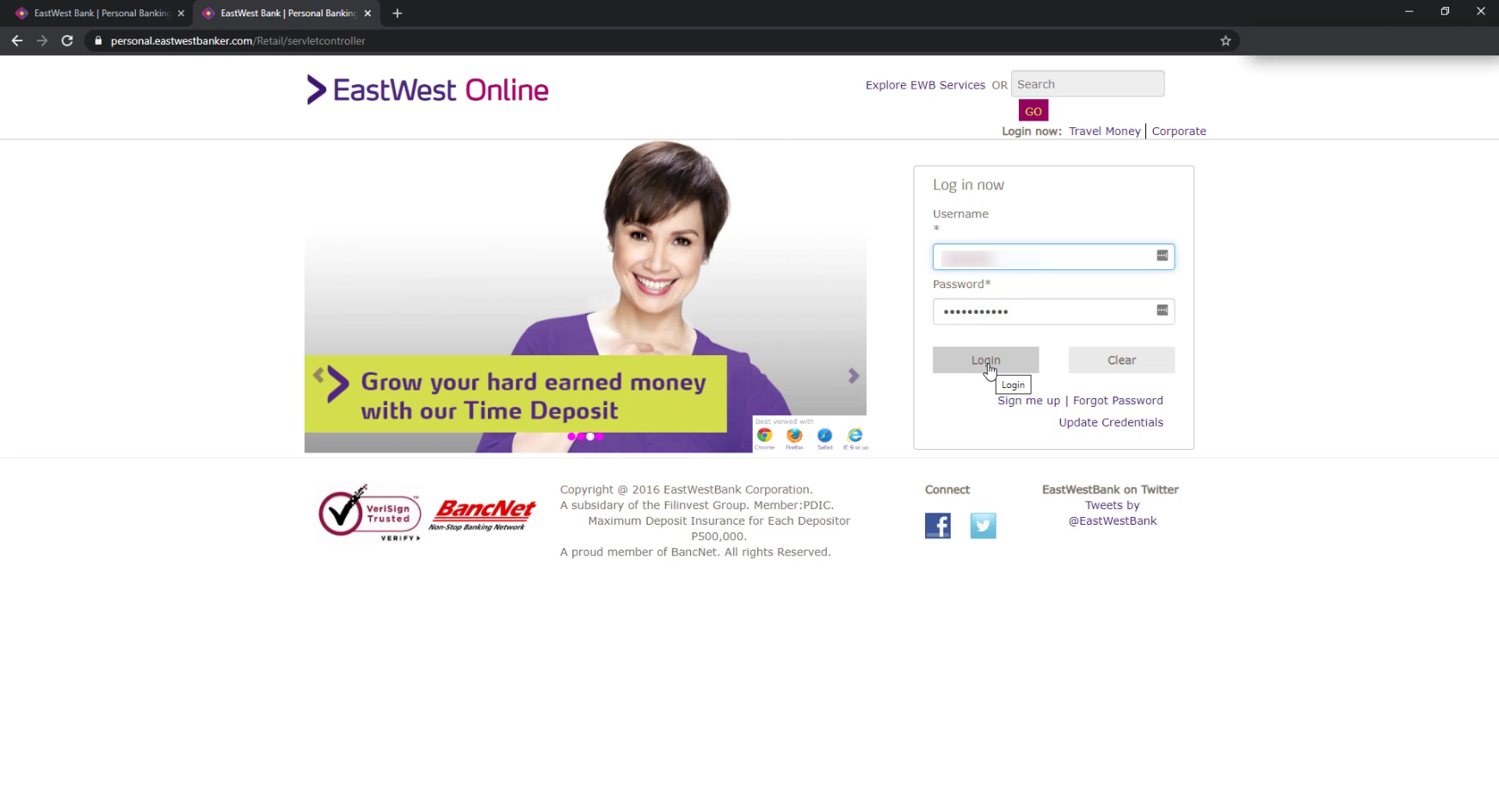

2. Incorporate On the web

After you pick a loan provider, you could potentially get a consumer loan . Applying on the net is the fastest and you will easiest way. As you become been, know that there are a number of unsecured loan conditions you’ll want to meet. As an instance, you are going to need to submit an application and supply a few data files, instance evidence of money, a career, and you will name. Assemble this type of data files in advance and also all of them in a position.

3. Receive Fund

Once you may be approved to possess a personal bank loan, you’ll receive the cash inside a lump sum, always contained in this a couple where can i get a loan Oak Hill of days. Particular lenders even give exact same-date resource. You may then pay back the bucks you owe that have focus over time inside monthly installments.