Variations and Similarities Ranging from a house Guarantee Financing and you may a good HELOC

- The newest mark period: You can use the fresh new account so you’re able to acquire and you may pay off currency freely. This period normally persists 10 years, at which point the loan movements on the payment months.

- The newest installment period: You might don’t borrow against the credit range in this date, and really should pay off the fresh the equilibrium. The latest payment several months normally persists 2 decades.

The rate you might be considering will depend on the credit scores, income, in addition to lender’s formula

Interest rates towards the HELOCs are usually adjustable, associated with had written sector pricing and you can already include a low regarding dos.5% to as much as 21%.

An element of the difference in a property guarantee credit line and you will a good HELOC issues the way you discover and you can pay off everything obtain. According to way you intend to use the lent loans, you to definitely or perhaps the other could be considerably more affordable in terms of interest costs.

Which have a property collateral mortgage, you obtain a complete level of the loan since mortgage is approved, and you must pay it back more than a set level of fixed monthly payments. Payment episodes typically range from four so you can a decade, but 20- plus 29-seasons conditions is actually you can easily. The level of notice you’ll shell out over the life of the fresh financing is essentially recognized from the beginning; you will be capable save your self certain notice of the settling the new financing early, however some loan providers charges punishment for spending funds away from prior to plan.

That have a beneficial HELOC, you can potentially save very well notice costs for people who maintain your distributions apparently small and pay down your own fast cash loans Larkspur balance between costs.

You will be able to deduct desire money into the house equity lines of credit and HELOCs when you document your government earnings fees, just as you are doing pri, you are able to merely deduct interest to the home guarantee financing otherwise HELOCs in the event your financing continues are used to create renovations. Your complete annual deduction with the focus off all home loan, home guarantee and HELOC funds don’t go beyond $750,100.

Option Sorts of Financing

Domestic security finance and you can HELOCs can be anticipate sources of in a position cash to possess qualifying residents, nonetheless they bring significant dangers: If you’re struggling to keep up with your repayments on the property collateral financing or HELOC, the lending company has got the to foreclose and take possession off your property.

- Personal loan: A personal loan is a variety of unsecured credit, meaning that it doesn’t require you to created possessions given that collateral contrary to the financial obligation. Loan number ranges away from $step one,000 so you’re able to $10,one hundred thousand, and you can interest rates are very different generally, based on credit score and you will income height. You will be in a position to be considered which have a good credit rating, however, a credit history from the an effective variety or best tend to leave you entry to a wide list of possibilities.

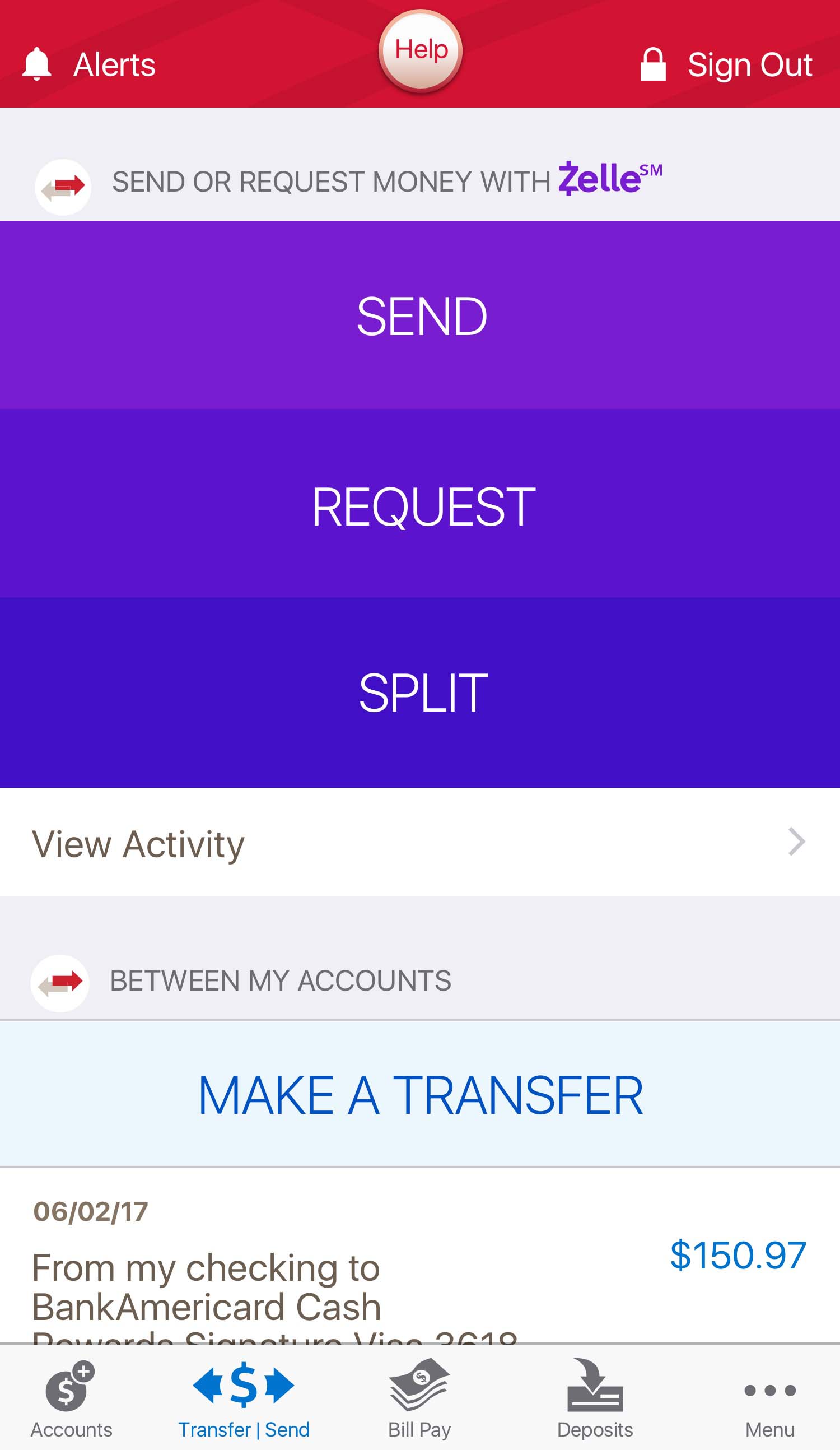

- Credit line: Banking institutions and you can credit unions allow it to be individuals having a good credit score to open lines of credit-revolving credit accounts which do not require security otherwise which use brand new items in a certification from put (CD) since the collateral. Like HELOCs, this type of lines of credit allow it to be withdrawals and you will payments in adjustable wide variety, and simply charges interest into an excellent balances. Lines of credit provides limited mark and you will cost symptoms, which are normally smaller as opposed to those for HELOCs-only three to five age for each and every.

- Peer-to-fellow financing: These could be got as a consequence of on line creditors you to meets traders wishing to procedure money having borrowers seeking funds. Labeled as peer-to-peer or P2P loan providers, web sites don’t check always credit ratings, nonetheless manage normally wanted evidence of income or other possessions. Peer-to-fellow networks will likely be a beneficial capital for less loans (typically $5,100000 otherwise reduced). Payment attacks toward P2P money are typically quite small, five years otherwise quicker.