Top HELOC Lenders versus. Almost every other Financing Choices

Rating prequalified or preapproved which have numerous lenders, in order to evaluate rates of interest predicated on your creditworthiness. When the official source a loan provider has the benefit of a basic Apr, make sure to evaluate this new constant Apr.

You’ll also want to consider almost every other costs you may be topic to help you, in addition to origination charge, most other lender settlement costs, yearly costs and you will very early cancellation charge. In the event the a loan provider offers to coverage your own settlement costs, verify if you’ll find strings attached, including keepin constantly your account discover getting at least amount of go out.

Mortgage Amounts

Consider your financial requires and you will specifications to determine how big is regarding a borrowing limit you would like. Do a comparison of the mortgage numbers that each financial even offers, together with loan-to-value ratio (LTV) limitations, to determine whether or not you can buy what you need.

Cost Selection

The product quality name to own a great HELOC is actually 3 decades, broken up for the an effective ten-12 months draw period and you may a beneficial 20-year payment months. However some lenders may offer significantly more independency according to your position.

Along with, if you’d like the very thought of transforming your loan balance so you’re able to a predetermined interest rate to protect oneself out of a prospective raise on your changeable rates, discover loan providers that offer one possibilities.

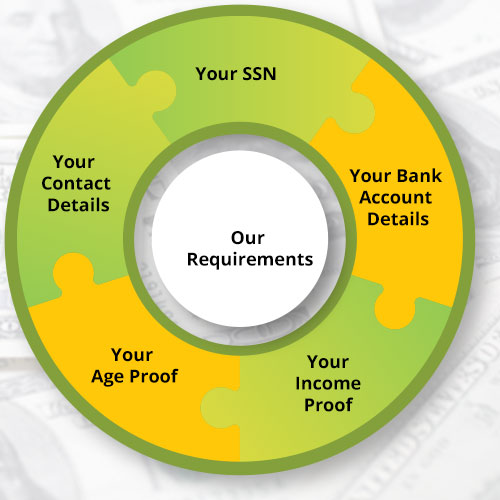

Qualification Requirements

You are able to generally speaking need a credit score out-of 620 or higher so you’re able to become approved for a HELOC, but some lenders require a higher rating than just one to. Check your credit rating to obtain an idea of where you stand, following desire your hunt toward loan providers that provide a good chance out-of recognition.

Additional features

Depending on your situation, needs and requires, it is possible to envision other features HELOC loan providers ple, your options is generally minimal when you find yourself contemplating providing good HELOC on the an investment property. You can thought loan providers that offer rate of interest savings, punctual financial support or other provides which might be a priority to you.

Dependent on your position, a HELOC might or might not promote all you have to to accomplish your aims. Before you apply to own a great HELOC, you should lookup any options to guarantee that you get what you would like. Here are some possibilities you can evaluate.

Most readily useful HELOC Lenders against. Family Guarantee Loan lenders

Such as for example an excellent HELOC, a property collateral financing allows you to faucet their property’s collateral. Home collateral fund promote a fixed interest instead of an effective adjustable one, and you will probably rating a lump-contribution disbursement, that you’ll pay more four to 30 years. A house guarantee mortgage could be worth considering if you want investment getting a single situation plus don’t thinking about wanting ongoing entry to borrowing from the bank.

Top HELOC Loan providers vs. Cash-Out Re-finance Lenders

Having a finances-aside home mortgage refinance loan, you’ll refinance your existing home mortgage in the place of taking out a 2nd financial. You could make use of this financing to get into a number of your own house’s guarantee. A funds-aside re-finance would-be worthwhile considering if you possibly could be eligible for finest terms than you may be using on your newest financial, although alternative come with hefty settlement costs.

Better HELOC Loan providers vs. Individual Loan providers

Unsecured loans bring a lump-contribution disbursement, which you yourself can pay-off more you to 7 decades, according to the financial. In lieu of HELOCs, signature loans normally don’t require security, thus there is no threat of shedding your residence if you standard. Nonetheless usually costs higher interest levels as well as have less cost conditions, providing you shorter monetary self-reliance.

Finest HELOC Lenders versus. Playing cards

If you need one thing for casual spending, credit cards is generally a far greater choices than an effective HELOC. Handmade cards will give advantages for each purchase you make, and you may usually avoid focus fees for many who spend your own statement completely every month. However, highest rates of interest build handmade cards reduced glamorous getting large commands, house renovations otherwise debt consolidation reduction.