Ohio FHA Loans so you’re able to Money Ratio Criteria

New Government Housing Management, otherwise known as FHA, brings financial insurance for the Ohio FHA fund awarded because of the individual loan providers. FHA is the largest insurance company regarding mortgages around the world! The loan insurance coverage awarded from the FHA provides loan providers with safeguards facing loss because of default.

So what does this mean to you personally? Considering the less risk to help you loan providers, they can give more cash througout Ohio’s 88 counties.

Ohio FHA Financial Qualification Assessment

- consume your house as your no. 1 house

- possess an advance payment of at least step three what is an ibv check.5 % of your cost

- be able to pay the payment, since determined by the debt to help you earnings ratio

- manage to file a minimum of 2 yrs from employment records. Zero it does not must be with the same boss.

- n’t have got a bankruptcy proceeding over the last 24 months and you will not got a foreclosures over the past three-years (dependent on the latest time the house directed from your own identity)

- meet lenders borrowing from the bank criteria, each other rating and record

Kansas FHA Mortgage Occupancy Basics

FHA just means funds getting primary residences. This means that you should reside in the house or property, and ought to move into our home in this two months away from closing.

- Unmarried Relatives Homes a structure managed and you will used because the one house tool. It may express onre or more structure with some other house tool.

- Condo a developing otherwise comples regarding property who has an abundance of physically had homes. Residents share during the joint ownership of any common factor, passageways, an such like.

- Multi-Device Features (around 4 systems) numerous independent housing gadgets getting domestic purposes contained in one single building.

- Are built homes a cellular house that fits HUD Password, and that’s deeded as real estate, perhaps not inside a mobile household park.

FHA need a down-payment out of 3.5 % getting consumers that have a center credit score out-of 580 or higher.

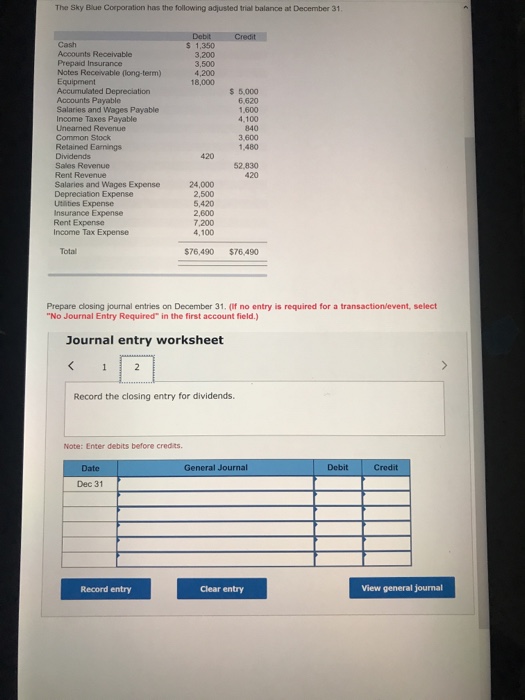

The debt so you’re able to money ratio (DTI) is employed to decide whether you can afford new recommended monthly percentage on the a keen FHA home loan.

The fresh new front-end loans to money proportion is computed by dividing the brand new proposed monthly payment toward FHA financial by your gross (ahead of taxation) monthly money.

New back-end financial obligation in order to money proportion was determined from the splitting the fresh advised monthly fee towards the FHA financial As well as the payment per month for everyone debts noted on your credit history by the disgusting (in advance of taxation) monthly earnings.

FHA guidelines limit your front-end ratio so you’re able to 29% as well as your back-end proportion in order to 43%. But not, discover some flexibility for borrowers whom receive an affirmation because of FHA’s automatic underwriting system, also known as Complete Scorecard. Complete Scorecard is agree files as high as % back-end proportion.

Kansas FHA Mortgage A position History Concepts

Fundamentally FHA necessitates that a lender file a borrower’s most recent 24 months a career history. If perhaps you were out from the employees for an extended time, and also merely returned to the fresh new employees, the loan manager will be able to advise you for the correct paperwork that will be required.

Kansas FHA Borrowing from the bank Standards

One of the most significant causes one FHA financing are so well-known is the fact FHA does not require the greatest credit score.

FHA’s recommendations accommodate a borrower which have a center credit rating only five-hundred to locate a mortgage. Although not, loan providers have a tendency to demand more strict guidelines. Most lenders need an effective 620 or a great 640 center credit history to track down FHA capital. There are certain options down seriously to a good 580 score also. Borrower’s whoever center credit score was below good 580 will have trouble protecting investment.

FHA makes it necessary that couple of years features elapsed as the release of a part eight bankruptcy, 36 months as the a property foreclosure, without wishing several months immediately after a chapter thirteen bankruptcy proceeding has been released.

To discuss the options having a kansas FHA Mortgage you could potentially Contact Myself or finish the simple, Kansas FHA Speed Quote Demand function.