Inside my sophomore seasons inside college or university, my moms and dads called myself at my dorm space with a few extremely important reports

Now, based on a vermont Moments breakdown of , worldwide a home erican home loan crisis from inside the places since various other due to the fact Ireland and you will Asia. Most quickly, this new crisis have remaining the actual genuine possibility one an incredible number of Us americans loses their homes, nearly all which seem to be in the precarious financial factors. Once the Lawrence Bowdish, an effective PhD applicant into the financial records at the Ohio County, reveals, how financial drama are playing call at this new United Says is a result of the truth that you will find enough time viewed family possession as central so you can “new American dream” for everybody Us americans, but i have set up an effective “two-tiered” financial system and this will not send on that dream equitably.

Our very own scheduled weekly calls taken place to the Weekends, and so i answered which mid-week name with some trepidation. Unlike burdening myself which have not so great news, my happy mothers called to let me personally be aware that they’d paid down the mortgage toward house that they had possessed as the latest late 1970s.

Having equal fanfare, my father took out another type of financial many years afterwards to help you assist funds a growth to help you his small company. My personal youthfulness domestic try both my parents’ largest financial load and you will the best investment, as it is for unnecessary People in the us, because of the peculiarities of home loan market from the United States. Within nation, the borrowed funds market is likely to higher development compared to the brand new rest of the globe due to the fact different countries want extra money up front and require payment easier.

Recently, you to field provides been through some serious and you will well-publicized volatility, making many people at risk of foreclosure. Considering specific estimates, over a couple billion mortgage loans are in danger out of property foreclosure this season. Others commonly because happy. Their capability to cover its monthly installments is jeopardized first because of the the fresh dropping market, next because of the mortgage loans they may not afford. Both kind of home owners have purchased toward American dream of home ownership, fostered by the an article-World war ii authorities wanting to find someone once the home owners. However, aforementioned group is during big chance of foreclosing on that fantasy.

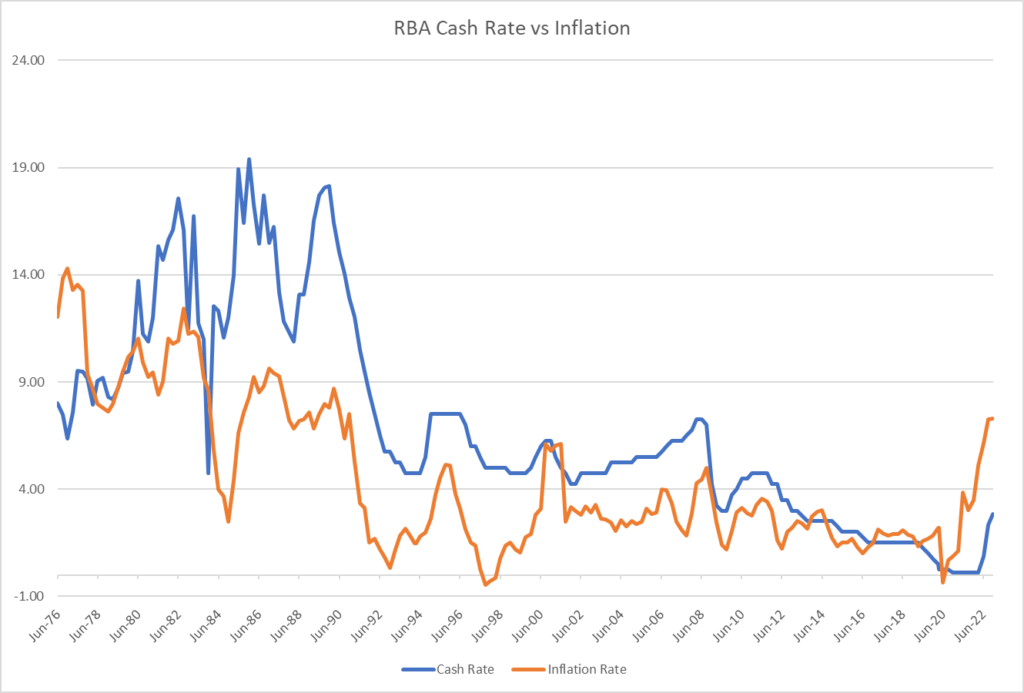

Brand new failure of your own housing industry in the united states possess got a critical effect on borrowing from the bank markets not only in the fresh new You but worldwide

Today’s crisis is partly a result of the shortcoming of a few borrowers and make mortgage payments to your very-entitled “sub-prime” mortgages he has. These mortgages have very reduced “teaser” interest levels to possess a fixed period ranging from that four years, then rates of interest commonly increase substantially next period. However, this might be simply area of the story. More importantly, the current drama is a result of the history of one’s financial from inside the the usa. Specifically, the borrowed funds industry developed into a two-tiered system with all the way down and upper class residents who may have never ever been able to effortlessly deal with lower-earnings people who had been usually female, racial and you may cultural minorities. Only by considering the market’s history and you will attempts to rationalize and you will regulate it can a more done tale of your own newest sub-finest mortgage drama emerge. You to definitely facts and its own background is an elaborate one that includes the loan market, attempts to handle they, while the veracity of the “Western Fantasy.”

Particular, instance my personal mothers, are not at stake because they enjoys a good credit score, are able the fresh new monthly premiums, and you may are now living in a https://paydayloancolorado.net/cope/ location where housing can cost you and you can taxes features stayed secure

Even when politicians plus the news will represent homeownership as central on the “Western Dream,” one to dream is actually a variable feel framed perhaps not of the individual focus having a home, however, mainly because of the government and you may financial regulations. Government entities has a lengthy history of supporting homeownership. On one side, for the reason that home possessing follows a standard “American” pattern from individualism and you will privacy you to increased out-of personal change around the turn of the 20th century. On the other, home owners is a succinct group, utilized for counting and you can tax purposes. At exactly the same time, homeownership demands a lengthy-label resource one to encourages healthier involvement throughout the market. Regulators service to possess homeownership started long ago, the funds income tax home loan deduction was available in 1913, and continued from twentieth-century.