How to use an FHA Build Financing to finance Home Home improvements

You’ll be able to fool around with an FHA framework financing so you’re able to remodel good household. Otherwise need certainly to create a property, you can remodel to make it ideal for the ones you love. The fresh new Government Construction Administration may be able to assistance with new FHA 203(k) mortgage system.

There are 2 types of 203(k) fund. The first is brings finance up to $35,one hundred thousand. These types of loan can often be employed by property owners who possess reduced recovery strategies. The other try a more impressive type that can be used so you’re able to pick good fixer-higher. The larger variety of 203(k) mortgage can also be used having significant renovations.

Like other FHA finance, discover restrict mortgage restrictions to possess a good 203(k) financial. These loans try limited of the nationwide FHA financing restrictions.

The way to get an FHA Design Mortgage

Getting an enthusiastic FHA mortgage to build property is of interest given that you really have control over every aspect of your house. But many lenders wanted a ten% so you can twenty-five% down payment in terms of brand new conditions getting construction finance. FHA design fund could possibly offer off money only step 3.5%. This is very ideal for consumers trying to make a property.

Get Pre-Approval

First, just be yes you might be qualified. Make sure to meet up with the income, resource, and you may credit score recommendations. Otherwise see FHA direction, you won’t have the ability to apply for this type of mortgage. Thankfully that the FHA assistance are easier to satisfy than conventional mortgages.

Come across a creator

When you’ve become accepted to own FHA investment, you ought to choose installment loans no credit check Hamilton the best creator to your opportunity. You’re going to be spending a large amount of time with this person in addition to their business along the second months so you can a-year. It is best to make sure you get along. Put differently, be sure to and your builder have sufficient biochemistry to communicate certainly.

Investigate builder’s profile out-of performs. Learn how a lot of time they might be in operation, its areas of expertise, and types of systems they work on. Ask just how long comparable plans took to-do. You ought to rest assured the fresh new builder you decide on is in a position to from finishing your project not only on time and also contained in this your financial budget.

Creator Recognition

When you come across a builder, your own financial will need to agree the fresh builder. An enthusiastic FHA build loan means granting just new debtor but the fresh new builder too. For instance the debtor, the fresh creator should provide a summary of records to help you the financial institution. This could is things like profit-and-loss comments, licenses, taxation statements, records, an such like. The procedure of getting your creator approved usually takes anywhere between 2 and a dozen months.

Website Choices

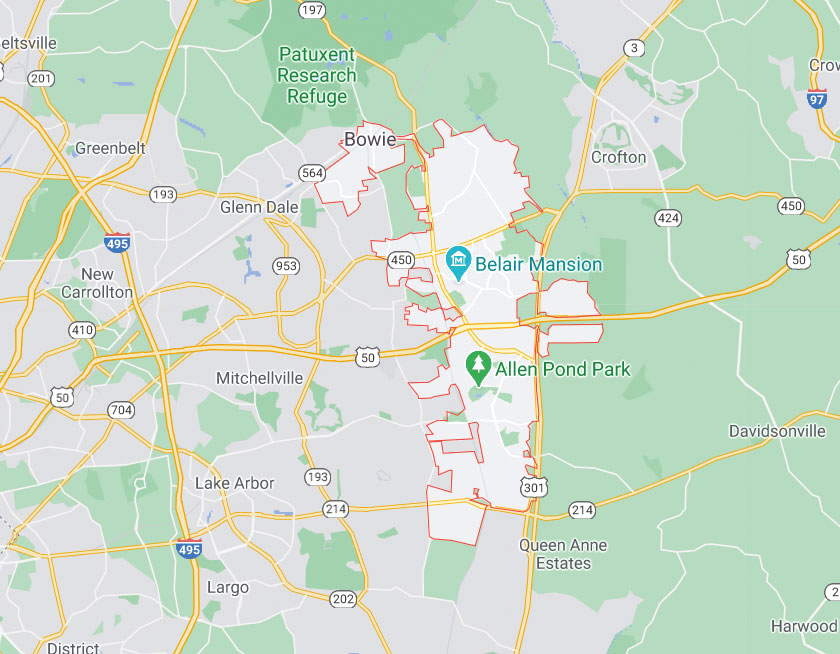

When both the borrower additionally the creator is acknowledged, it is time to discover assets in which you’ll generate our home. Understand that you need an FHA construction mortgage to invest in this new homes therefore the family all in one loan. This new FHA doesn’t promote people value so you’re able to existing structures to the property. They use the appraised value of the property in accordance with the intense property.

Enterprise Acceptance

When you yourself have website picked, you get wide variety in the creator. This type of covers just what will set you back is always to finish the enterprise. When you’ve be prepared for the fresh new builder on these numbers, the financial institution evaluations the construction arrangement and you can formations the mortgage rightly.

And you will, the newest debtor victories. Because the builder accounts for payments, he’s got an incentive to-do your panels. The fresh new builder doesn’t want to track down stuck having paying the construction loan’s appeal costs more than simply needed. The borrowed funds is converted to new FHA financing when the house create is done. New borrower upcoming takes over to make payments on that mortgage.