How many FHA Loans Might you Provides meanwhile? An intensive Book

Because a mortgage elite group that have many years of feel, We have encountered of several questions relating to FHA money. The one that usually shows up try, Exactly how many FHA fund can you enjoys? The solution isn’t as simple as you imagine. Why don’t we plunge towards information and find the nuances of this crucial matter.

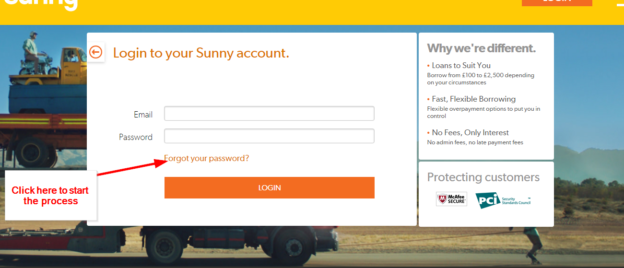

Request a no cost Mortgage Consultation

- The entire rule is that you could simply have that FHA mortgage immediately

- There are exclusions that enable to own multiple FHA funds inside certain products

- Understanding such conditions can open up a lot more ventures to own homeownership

- Each state is unique and requires careful consideration

The overall Code: You to FHA Loan immediately

The Government Casing Management (FHA) generally allows borrowers to own only one FHA mortgage within good time. This signal is during put as the FHA money are designed to let someone get first residences, perhaps not investment qualities otherwise trips land, regardless if he has a current FHA mortgage.

FHA mortgages were created having first residences, but there are exceptions on the that-loan rule. Understanding such conditions can be critical for particular homebuyers and you will owners.

Exclusions towards Rule: If you possibly could Provides Several FHA Funds

The newest FHA understands that lifetime situations is necessitate that have more one FHA financing. To get eligible for one minute FHA financing, you really must have no less than twenty-five% equity in your home otherwise features repaid the latest FHA loan balance so you can 75% in a number of issues.

step 1. Relocation having Functions

- The new place should be at the least 100 miles out of your most recent house

- You must have a real a position-related cause for the new move

2. Boost in Family members Proportions

In the event your members of the family has expanded as well as your latest family no more suits you, you may also qualify for a different FHA mortgage. So it generally applies when:

- Your domestic is too tiny for you dimensions

- The rise for the household members size occurred when you bought your domestic

3. Leaving a shared Mortgage

While you are listed on an FHA financing that have a former mate or co-debtor, but you’ve remaining the property, you might be qualified to receive yet another FHA loan to shop for your house.

4. Non-Occupying Co-Borrower

While a low-consuming co-borrower towards the someone else’s FHA mortgage, you might still qualify for your own FHA loan to have property you want to invade.

5. Trips Belongings

In a number of rare circumstances, the brand new FHA could possibly get ensure it is a debtor to acquire a second FHA loan getting a holiday domestic. It is generally simply enabled in the places that antique funding is not available.

Extremely important Factors getting Numerous FHA Funds

While such conditions are present, it is very important remember that qualifying for several FHA loans actually automated. About FHA mortgages, check out tips to adopt:

- Fulfilling Standard FHA Conditions: You are able to still have to meet most of the standard FHA loan conditions, and credit score, debt-to-money ratio, and you will down-payment conditions.

Choices to take on

Otherwise qualify for another FHA financing or if it is far from an informed financial move, examine these possibilities to the FHA loan system:

Just how DSLD Mortgage Will help

Navigating the complexities away from FHA finance, especially when offered multiple fund, is going to be tricky. During the DSLD Home loan, we focus on enabling our very own website subscribers know their choice while making informed choices. We are able to:

Conclusion: Training was Electricity when you look at the FHA Credit

Just like the general signal is you can have only you to FHA loan at a time, knowing the exclusions to this signal normally open up a great deal more possibilities for the homeownership travel. Whether you’re relocating to possess works, broadening the ones you love, otherwise facing almost every other lifetime change, there could be a path submit that have FHA financing.

Think of, for every single condition is unique. What works for just one borrower might not be the best choice for another. It is important to work with experienced experts who is also make suggestions through the the inner workings away from FHA financing which help you make the fresh new most pay day loans in Crisman CO readily useful choice for your monetary future.

If you are considering the next FHA mortgage or enjoys questions about the FHA financial loans, please reach out to all of us during the DSLD Mortgage. We’re right here to navigate this type of cutting-edge choices and find an informed road to reach finally your homeownership specifications.