How a bridge Loan Makes it possible to

New Yorkers commonly not be able to obtain the downpayment when purchasing good possessions within the New york city. Delivering a home loan isn’t really simple. Many selections help anybody will ownership off an enthusiastic Ny household. The 2 most significant questions consumers face when delivering approvals are income therefore the deposit. Va financing do not require a downpayment; yet not, civilians lack the means to access that kind of loan. Saving right up having a down payment isn’t really effortless, particularly if you need to upgrade your household. With respect to the situation, to shop for a link mortgage buying a house would be an excellent good option.

A connection Mortgage to get a home bridges the newest gap ranging from buying and selling. Manufacturers may use it purchasing a new San Jose loans family instantly. Their funds is tied employing home purchases, and this consist in the industry however, has never marketed. Which mortgage are small-title. Specific providers also can funds the customer temporarily. It’s titled seller’s resource.

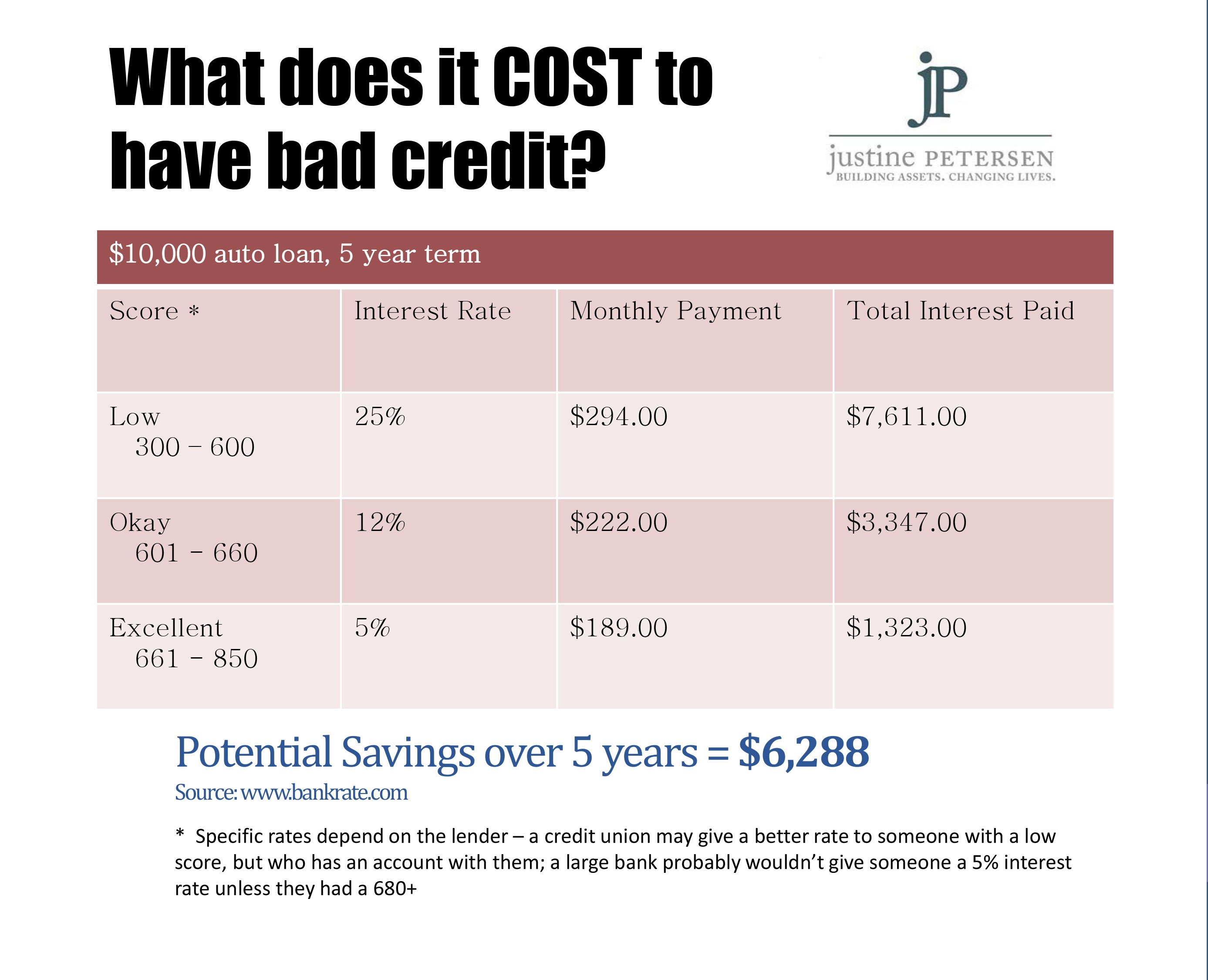

Lenders expect to get paid with the assets sales. not, connection loans hold large charge and you may interest rates. Some normal conditions to be considered are having a good credit score and having no less than a 20% security on your own property. Very connection fund occur in an attractive market.

So it mortgage provides temporary capital to own a property get as debtor obtains prolonged-identity financing. On Nyc a property world, customers play with connection financing to track down a deposit able on the an effective the latest possessions as they wait for sales of their own domestic.

Buyers fool around with bridge funds to help obtain the fund must buy a house, nonetheless are not long-term funds. Instead, he could be short-title fund that you should pay off towards business of your house comes otherwise in this a-year.

- Rating a deposit and you may protection settlement costs.

- The newest acceptance techniques is fast, that makes to order property less.

- Particular providers will require a buyer who’s got a connection financing more than a buyer whom does not.

They bring highest-interest rates and higher charges. The terms are quick, and it’s really a notoriously costly station, but it is a primary-identity services.

With one of these fund merely is sensible when searching buying a good possessions from inside the an attractive market. You realize your home will sell and want to move As soon as possible, and they are costly and you may quite high-risk. not, capable add up if you prefer a simple a property closing.

Just how can Connection Finance Really works?

- Pay your amazing home loan and give you more money to have a down-payment with the a special family. If family becomes ended up selling, you only pay off the link financing.

- In order to make a down payment for those who have currently paid back the household. You can use a bridge financing to find the down payment, and these financing is actually dramatically reduced from inside the guarantee.

What the results are in case the house is maybe not attempting to sell?

Particular loan providers could possibly get extend brand new words if you’re unable to see a customer inside annually. not, you need to pay your own home loan and the bridge loan, resulted in that loan default. If you aren’t pretty sure your house will actually sell, you should not aim for a bridge mortgage, that’ll easily backfire.

- At the very least 20% collateral of your home.

- Higher level borrowing from the bank. (no less than 720)

- Your home should be during the an attractive and water field.

Exactly what are the Alternatives So you’re able to Connection Fund?

- HELOC (Home Guarantee Lines of credit) – is a personal line of credit predicated on your home security. HELOCs bring a better price, all the way down costs, and a longer name. An effective HELOC have a tendency to nevertheless enables you to money renovations if the you don’t promote your house.