Exactly why do I need to Offer Lender Comments to track down good Mortgage?

The process of bringing a mortgage can seem to be private and you may hard. This frustration is sometimes on their top if the loan manager begins to consult files from you. Exactly why do you have got to provide financial statements whenever bringing an excellent home loan? Why don’t we read!

Why The loan Officer is actually Requesting The Financial Comments

The loan manager are requesting their lender statements as the lender, the new underwriter, and also the company you to kits the guidelines for your mortgage require it. When you’re putting in a software to possess a home loan, you have got to backup every piece of your own application for the loan having evidence.

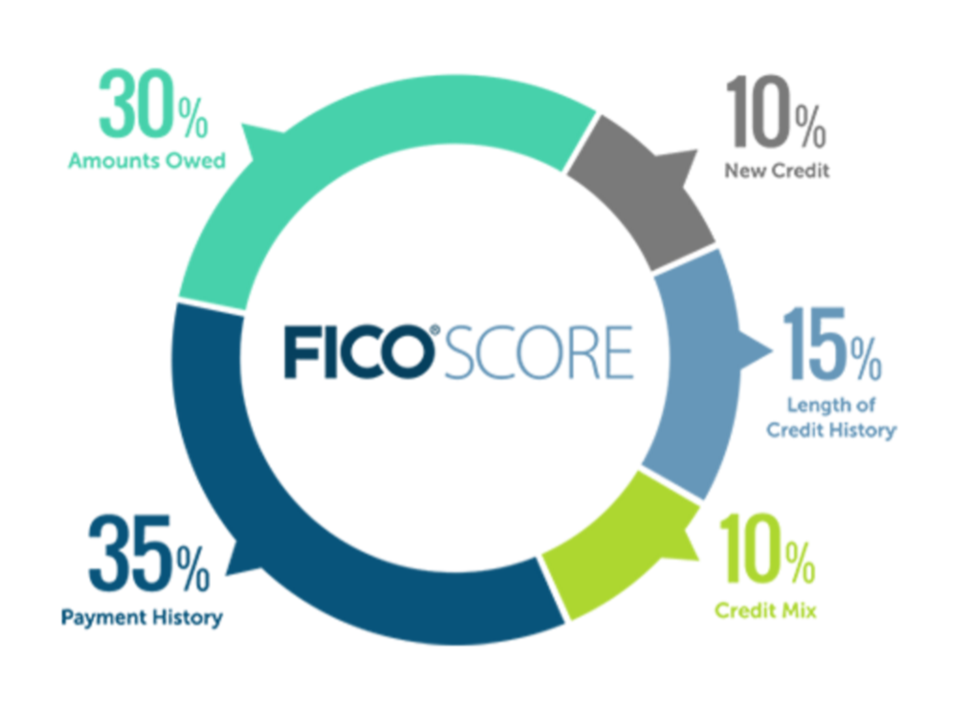

You need to establish your credit score, your earnings, their monthly payments, your residence record, along with your assets. When you find yourself to get a house you have certain aside-of-pouch will set you back when buying you to definitely home.

You have to prove that you have enough money required to close the borrowed funds. This can include your down-payment, closing costs, and you can people reservers you might need to help you be considered.

There is certainly basic paperwork which is deemed acceptable with regards to so you can the method that you demonstrate that you have the funds. They are complete statements from your own standard bank.

Whether you are utilizing your examining, deals, 401k, Cd, or other types of account you’ll want to render statements regarding financial or standard bank since the research you really have those money.

Exacltly what the Home loan company is looking for In your Financial Comments

In terms of what your bank wants, you will need to note just weren’t right here to guage your paying designs, or what you’re using your money for the. The underwriter along with your loan administrator are looking for about three top things:

- No Low-Payroll Large Places: If you have direct places coming in from your employer which is perhaps not an issue. For those who have most other dumps instance bucks, examine, Venmo, or any other highest places these things would be flagged and you can you will have to offer where money originated.

- No Recurring Repayments: Since bank is going to look at your credit history to be sure i make up all monthly bills, they’re going to as well as turn to the financial comments also.

When you yourself have extra costs having automobile financing and other particular loan coming out this isn’t on your credit report, the lender will likely need certainly to incorporate that personal debt in the monthly premiums.

- Loans to fund The Out-of-pocket Can cost you: Once we’ve appeared to have highest deposits and you may recurring repayments leaving the account, we’re going to have to make sure you have sufficient fund to help you safeguards the will cost you.

People profile you employ to show that you have money so you can pay your own closing costs will demand a comparable level of documentation and you can comment.

What exactly are Potential Warning flag?

The lending company Secrecy Operate is actually enacted from inside the 1970 and you can modified from inside the 2001 into All of us Patriot Work. Just like the those individuals updates, lenders need to proceed with the exact same means because the banking companies if it comes to blocking and you may closing currency laundering.

While we guarantee one non in our subscribers would be in it in any currency laundering strategies, we’re necessary for law to confirm the funds in a mortgage deal.

Along with these tips, banks also want so anyone who he could be lending currency in order to would-be browsing pay back the mortgage.

- Large Dollars Deposits

- Overdraft Charges

- Recurring Costs Perhaps not In the past Shared

Such will improve further research into your investment statements. The large put, that will be only $500 or even more, must be sourced and you may noted https://cashadvanceamerica.net/personal-loans-az/ proving where fund originated in.