Can i Get home financing Instead of Tax returns?

Really antique mortgage loans need tax come back earnings verification over the past 2 years to prove money. But there are numerous hours where a debtor may well not need to add taxation statements.

Apart from confidentiality, many people simply try not to tell you enough annual income so you can qualify for a home loan to their formal taxation statements, particularly when he could be thinking-working or take numerous develop-offs and you will business write-offs.

Mortgages Having Standard Wage Earners

Extremely non-salaried otherwise every hour workers simply need certainly to fill in W-2s otherwise spend stubs to verify income having mortgage degree. A lender can also need proof employment both from the app and prior to closing.

For those who earn extra shell out when it comes to overtime otherwise added bonus shell out, a lender can sometimes need to find out if to the company. For those who earn over twenty five% of their shell out from inside the commissions, taxation statements may still be required.

Mortgages Having Entrepreneurs

In some instances, those people who are advertisers otherwise independent builders cannot reveal sufficient money on annual taxation statements so you’re able to be eligible for a normal financial. In this situation, operator might want to submit an application for a financial statement mortgage.

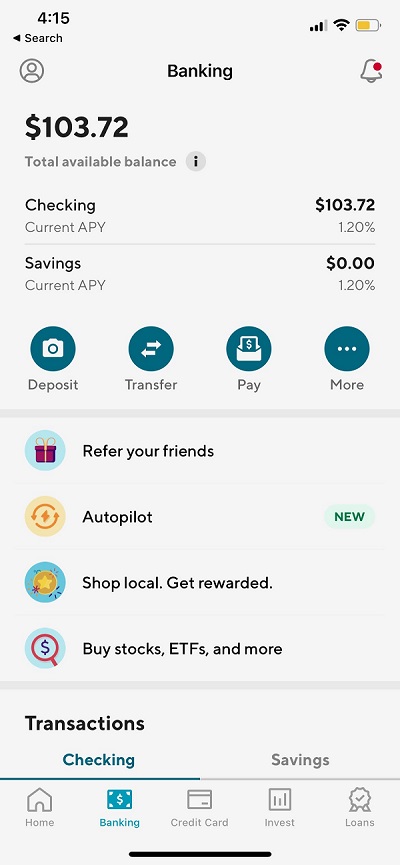

A sequence of one so you’re able to 24 months regarding lender statements often supply the lender a peek out of monthly earnings that won’t fundamentally become reflected on the a tax return for somebody whom was thinking-employed.

Certification Conditions to possess Bank Report Mortgage loans

- Self-a job – To try to get a lender statement mortgage, the fresh debtor must be care about-employed or a separate builder, but will not always have to be the actual only real manager of the business.

- Verification of organizations lifestyle – The firm need been in life for a time period of no less than 24 months. The lending company will demand confirmation of lives of your own business which have one or more of the following: a corporate list, a business permit, a website, a keen accountant verification letter, 1099s, or any other confirming points.

- Bank Declaration Criteria – Of several lender statement loan providers will require one or two several years of financial comments to choose an income. Generally speaking, month-to-month deposits might possibly be averaged, having fun with each other places of individual membership together with a portion off dumps out of company profile. A borrower can be necessary to show money direction from the business savings account on private family savings.

- Downpayment Demands – Various other financing circumstances has some other deposit criteria. While some will accept only 10% deposit, it does tend to count on the fresh new borrower’s additional factors, such as credit ratings, income, money on hand, or any other possessions.

- Credit score Standards – When you find yourself credit score requirements will vary off lender in order to bank, most loan providers want to see a score regarding 600 or higher. Other requirements including advance payment will get raise or drop off centered toward credit rating of your own borrower.

- Property – Underwriters are often seeking more financial issues, named compensating situations, that make a borrower a very glamorous degree chance. Extreme financial assets are a strong compensating factor that generate an effective borrower more desirable so you can a loan provider.

- Assets requirements – with regards to the lender, it’s possible to invest in a primary house, second home, or investment property off solitary-nearest and dearest to cuatro residential equipment. Cash-out refinances are also available.

loan in Groton Long Point Connecticut

Rate of interest Variables

Once the a lender plays higher risk with a financial declaration mortgage that will not need the typical verification paperwork, so it have a tendency to shows up in the interest. Whilst each and every bank is different, you will be given additional costs centered your credit score and/or level of the down payment.

Questions? I have Responses!

When you have extra questions regarding non-qualifying home loan items, get in touch with the good qualities in the NonQMHomeLoans. You can expect an over-all a number of financial points away from old-fashioned to help you private investor mortgages.