Bodies Guaranteed Home loans To possess East Condition, Hillcrest

- FHA money

- Virtual assistant funds

- USDA funds

- Va Home loan Locations

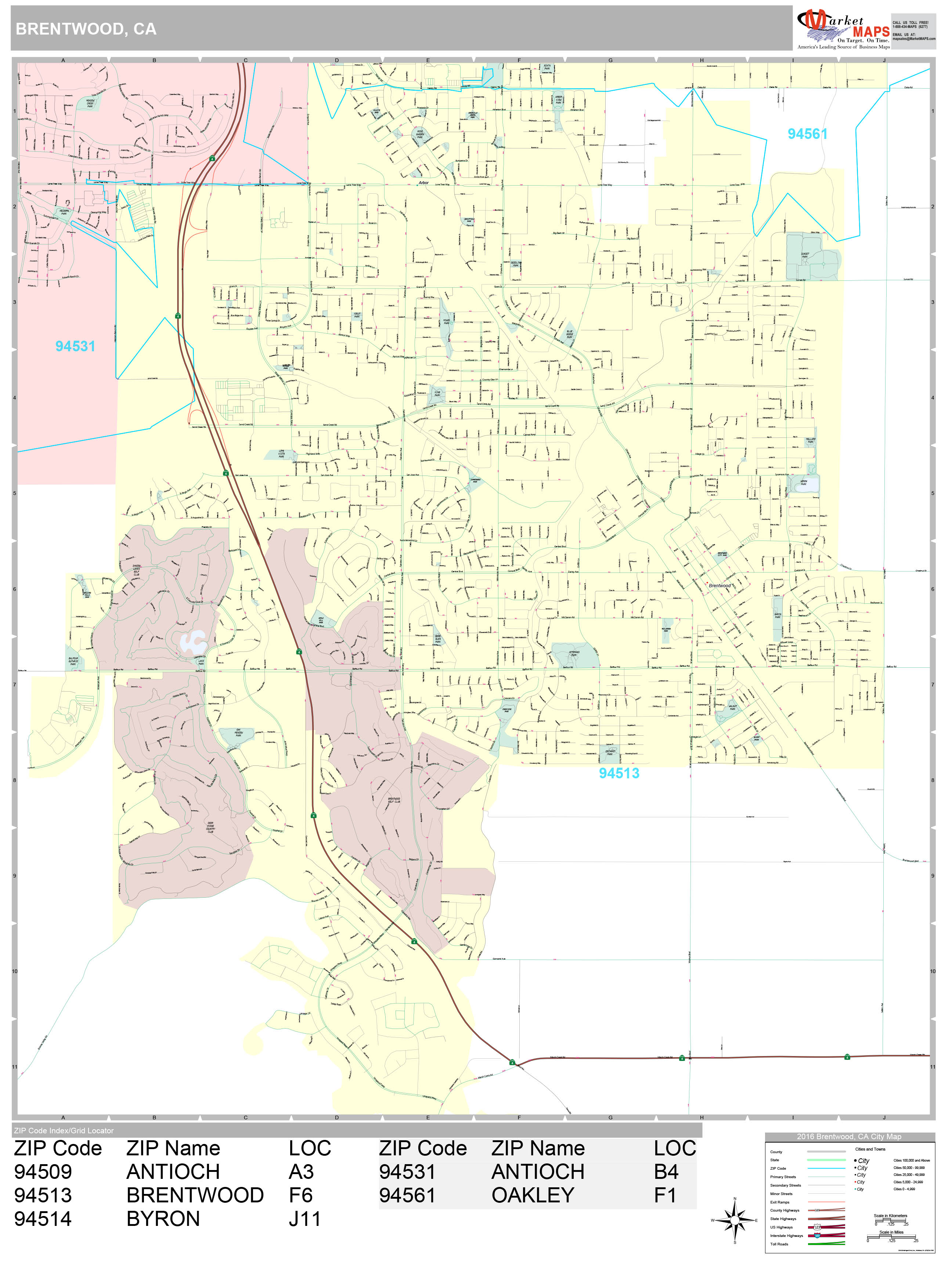

East State North park is home to an attractive surroundings you to accounts for all of the landmass having Hillcrest County. The eastern county is outlying, with lots of communities situated in backcountry parts referred to as Mountain Empire.

The latest eastern element of North park Condition is good for some one residing nature and you can taking part in additional pursuits like walking, slope bicycling, fishing, hiking, all of the contained in this a gorgeous mountainous desert. Brand new county is additionally the place to find fun Local American Gambling enterprises, that provide an exciting feel for all of us trying to appreciate particular Vegas-design fun.

Surviving in brand new eastern county is different from what individuals lifestyle along the coast you are going to experience in an even more ranged surroundings, big creatures, and you will a very regular climate. Somebody interested in to find a property from the east state enjoys to handle a median family price of $628,519, which can seem to be a touch too highest for the majority of these.

Luckily for us, home throughout the state can be found with Bodies-guaranteed lenders, reducing as well as deleting homeownership’s initially can cost you. These types of finance is actually protected by Federal Homes Administration (FHA), the newest Service from Veteran Factors (VA), and/or even the U.S. Agency regarding Agriculture (USDA).

FHA finance to have San diego Condition reaches $701,five-hundred to own an individual-nearest and dearest domestic, $898,050 to own an excellent duplex, $step 1,085,550 having a good triplex, and $1,349,050 to have a good fourplex

Loans given from the FHA promote a few of the most lenient qualification criteria out of any lenders available, causing them to just the right mortgage to have basic-date borrowers. For the reason that FHA mortgage brokers want your candidate enjoys a credit rating with a minimum of 580, even though some loan providers deal with actually straight down credit scores. However they wanted the lowest advance payment of at least 3.5%, rather below the regular mortgage requirement of 20%.

While doing so, FHA funds include some good experts, plus a lesser month-to-month homeloan payment number minimizing closing costs. These pros rather reduce the costs associated with homeownership so you can an enthusiastic reasonable amount.

Chapter 7 bankruptcy proceeding readers is also be eligible for that loan, all they have to would are features a-two-season pit off their launch go out. People having a section thirteen bankruptcy proceeding normally eligible for your house loan when they get one seasons out of and also Austin bank personal loan make money promptly as well as have judge recognition.

Individuals have to consider that FHA loans are necessary to conform to mortgage limitations, which can be different depending on the county where he or she is receive.

Hillcrest is a huge military city with many military angles and lots of Energetic Obligations Provider Users and Pros. Thus, it is the primary location for Virtual assistant mortgage brokers, exclusively for Pros, Productive Duty Service Professionals, and eligible spouses. Sensed by many home advantages among the most readily useful bodies fund offered, this type of finance has actually helped more than twenty two billion Pros choose the home of the desires.

It is due from inside the zero small-part as Va funds promote many perks, together with lower monthly mortgage payments, no-prepayment charges, and lower rates of interest. While doing so, Va funds supply a down-payment element no. Which means that a debtor you may get property without paying one thing in advance.

A newer benefit from Va finance is not being required to heed to Virtual assistant mortgage constraints, and that at the time of , have been got rid of. Today metropolitan areas instance Virtual assistant Home loan Stores render funds off up to help you $5 million for no currency off getting individuals who’ll afford it.

Mortgage restrictions were not removed to own Va financing consumers with several productive financing. He or she is nonetheless expected to follow loan constraints establish by Va, and that as of , has grown inside the Hillcrest State so you’re able to $701,five-hundred.

USDA money are getting consumers whose earnings is actually often from the otherwise beneath the money restriction into the condition. A credit rating with a minimum of 640 is also called for, although this is versatile, and lenders are more ready to work with the fresh applicant on the credit score.

At exactly the same time, these types of funds can just only be employed to get a moderate single-house, and no during the-soil pool. The house plus cannot be used for any organization objectives. It will be also found within a rural innovation urban area.

Once good borrower’s eligibility is decided, they could benefit from the loan’s benefits, in addition to a zero down-payment requirements, all the way down settlement costs, and aggressive interest levels. not, which loan does have loan constraints. For the Hillcrest Condition, that loan limitation is actually $615,000, a top financing maximum than in extremely USDA-qualified counties.

The loan is even more recognizing from candidates with gone through bankruptcies in earlier times

If you’ve ever questioned for folks who you certainly will are now living in East County San diego but pondered how much cash it would cost initial, up coming care and attention no further. Bodies finance decrease otherwise lose people costs entirely, effecting your purchase off property from inside the outlying southern area Ca an effective less costly function.