A beneficial Refresher Into A couple of Mortgage Reforms Kicking Inside Weekend

Into the middle-September, Minister off Finance Chrystia Freeland established a couple the brand new reforms meant to generate homeownership a great deal more possible and you can affordable to have Canadians: enhancing the speed limit to own insured mortgage loans by $five hundred,000 and you may considerably increasing qualification for 31-season mortgage amortizations.

McCredie’s issue is largely to your belief you to definitely expanding home loan intervals makes them economical

The new reforms build on the brand new 2023 Canadian Financial Rent – laws and regulations supposed to prompt customized service getting home loan people up against major monetary stress – and therefore, plus interest drops, “make mortgages economical and place homeownership back within reach having Canadians,” told you a moderate release in the Authorities regarding Canada.

First of all, the federal government has increased brand new $1 million rate limit to own covered mortgages in order to $step one.5 mil. Currently, mortgage insurance is not available to own land ordered for more than $one million, blocking of many create-be-homebuyers, specifically first-big date customers additionally the more youthful age bracket, off to shop for a home with a down payment regarding less than 20%.

The prior $one million cap was a grip-more out of 2012, when home prices were significantly straight down, explained the release. Nevertheless now, the average house rate during the Toronto clocks in within $step 1,106,050, at the time of November, along with Vancouver, homeowners see the typical cost of $step one,276,716, which means “average” house is now probably be northern off $1 million throughout these major towns and cities. With the rates cap set to improve to $step 1.5 billion, many more Canadians have a tendency to now have the ability to qualify for a mortgage and you may discover mortgage loan insurance coverage.

Accompanying the cost limit raise statement is the expansion of qualifications getting 29-seasons mortgage amortizations to incorporate the basic-day homeowners and all the produces. The latest extension adopted the latest ortizations – an attempt which was meant to build month-to-month home loan repayments a lot more reasonable for more youthful, first-day homebuyers, however, is actually criticized by the gurus to possess not effectively much-getting together with.

During the time, Toronto mortgage broker and you may commentator Ron Butler advised STOREYS that his firm’s calculation discovered the application do only be utilized by six% of large-ratio consumers. Now, “considering inflation and you may interest rates possess fallen, government entities was broadening usage of down month-to-month mortgage repayments in order to all of the very first-date homebuyers in order to every consumers of brand new stimulates,” told you the release on the Feds.

Over at this new Toronto Local Home Board (TRREB), Ceo John DiMichele notable the latest reforms, but forced to have enhanced access to. “You will find enough time advocated for these methods, specifically for homeowners to be able to switch lenders in the home loan restoration instead a frustration take to,” the guy told STOREYS for the ong loan providers is perfect for property owners and you may homeownership, so we repeat the require which scale to get lengthened so you can mortgage renewals just in case you do not require home loan insurance rates.”

When it comes to authorities, these include contacting those things “the most significant mortgage reforms for the years” and you may showing the new part they might enjoy in assisting reach the Fed’s want to create almost five mil the fresh new home, to make homeownership an even more reasonable dream to strive for

When you’re such government reforms get yourself work for homeowners, they could likewise have confident hit-into the effects in the home strengthening part, as Canadian Family Builders’ Connection (CBHA) Chief executive officer Kevin Lee pointed out. “CHBA is really thrilled to look for these types of progresses the borrowed funds guidelines,” Lee had said. “Most readily useful access to mortgages have a tendency to enable people to access the marketplace, operating alot more construction begins and giving globe a chance to push into needs to close off the production-request gap. Canada cannot try to twice homes initiate, or to industrialize the brand new housing marketplace to achieve that, if customers can’t pick-its exactly these policy change required in order to make brand new standards needed to move forward.

However, Ross McCredie, Chief executive officer of Sutton Category, seems the new reforms may not be while the impactful as authorities and others say they’ll be. “I don’t know that two notices now, materially, will likely changes far,” McCredie told STOREYS during the September. “But needless to say, the federal government are acknowledging there is a huge situation regarding homes and overall cost within the Canada.”

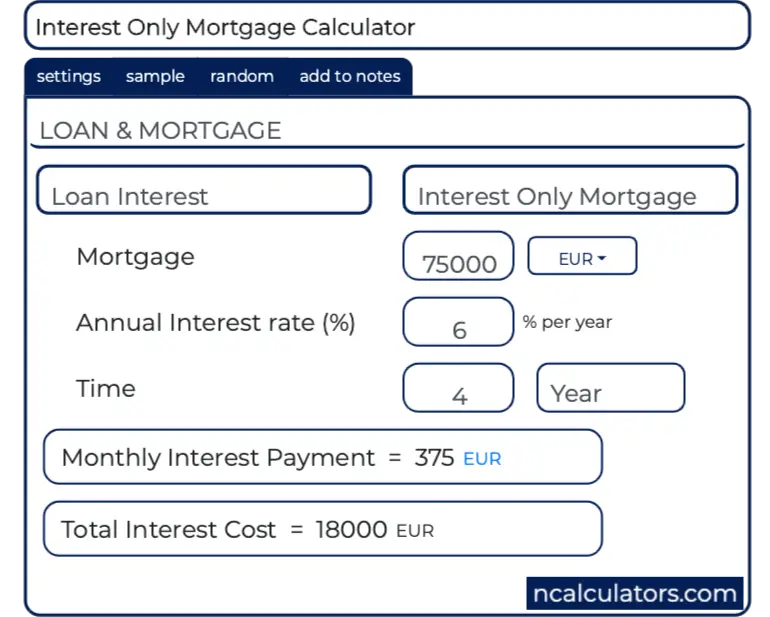

“If perhaps you were my personal closest friend and also you requested myself in the event the you really need to [go into a 30-season mortgage], I recommend your installment loans in Maine maybe not get it done, due to the fact a lot of the big date the basic math is not in your favour,” said McCredie. “You may be far better over to cut back a little bit prolonged and make sure as you are able to pay for a 25-seasons mortgage. In fact, we should lower people financial as soon as possible.”

Their most other gripe is that the reforms target very first-big date homeowners, which he feels are not the brand new phase which is the latest of them to move this new needle toward construction affordability. “When you yourself have jobless cost increasing and you may actual GDP wide variety upcoming off, people don’t believe in the latest cost savings,” McCredie told you. “And you may thats problems when 70% in order to 80% away from presale apartments, such as, throughout the GTA and Toronto, are bought from the traders after which rented aside. Men and women are not going to the dining table predicated on these types of [reforms].”

Visitors is worth a secure and you can affordable spot to name household,” said Property Minister Sean Fraser. “And they financial measures goes a long way in helping Canadians looking to purchase its very first domestic.”