What Programs are available to Assist African Americans Getting Homeowners

Homeownership possess historically assisted family members carry out a legacy and build enough time-label wide range, said AJ Barkley, Community and you can Society Credit Administrator having Bank away from The usa. Homeownership facilitate individuals to expose coupons punishment, appreciate income tax gurus and you may include on their own from ascending leasing pricing. This, alongside property you to definitely appreciates over time, often leads to help you improved money to own people.

Based on 2019 study regarding the United states Census Bureau, new homeownership difference between White non-Hispanic Americans and you will Black Us citizens is the largest in the almost 31 ages.

Homeownership about You.S. try 64.6% when you look at the 2019 – an overall economy one stimulated so many property foreclosure. New homeownership rates among Whites are 73.3% as compared to 42.1% certainly one of blacks.

If you are most other racial organizations watched a rise in homeownership by the since very much like 6%, the interest rate certainly Black Americans fell .02% of 1994-2019.

Whatever the intricacies off computing personal riches in the us, racial disparities inside homeownership gamble a steady and significant character. It is where guarantee is created, relatives balance requires means and you may generational wealth is actually passed.

Wells Fargo’s $60 million ten-year dedication to boost by 250,000 the amount of Ebony homebuyers first started in the 2017. Other businesses achieved speed in the wake out-of George Floyd’s dying into the late in addition to Black colored Life Count way.

Equivalence is certainly center in order to just loans no credit check Powell AL who our company is in the Bank off The usa, said Barkley, who contributes that the brand new occurrences away from 2020 deepened our commitment.

Lender regarding America individually produced an effective $1 mil, 4-season partnership concerned about address opportunities and attempts to assist local communities progress racial equality and you may monetary possibility, he said. We assured to deploy money and you may info to help you encourage financial gains to possess organizations regarding colour, having an elevated concentrate on the Black colored neighborhood.

That it commitment has been risen up to $step one.25 billion more 5 years to help expenditures to address racial fairness, advocacy and you will equivalence for all of us and you will organizations out-of colour.

Housing advocacy organizations – listing a long history of redlining together with new scourge off subprime financial financing one to caused the favorable Credit crunch regarding 2008 and you can disproportionately sparked home foreclosures certainly African Americans – state finance companies is in the long run focused on fixing a difference it assisted would.

The newest credit programs is actually geared towards people whom pick a property in lowest-to-reasonable money organizations, the phrase which comes from census study.

Not totally all software made to narrow the fresh control gap is creations away from lending institutions, but some are. Particular present bank software is actually a rise so you can existing attempts if you find yourself anybody else are completely the latest.

The National Connection out of Real-Home Brokers (NAREB) A couple of Billion The fresh new Black Citizen Program (2MN5) – Now offers advocacy getting Black homeownership and you can assistance with entry to credit and area and you can community creativity ideas one foster possession, one of almost every other initiatives

The brand new Chase Homebuyer Offer Part of a $30 million JP Morgan Chase pledge to close new racial riches pit. If this debuted they provided an effective $2,five hundred grant and home financing rates regarding step three.25 percent compliment of a fannie mae loan for the purpose of resource forty,000 mortgages in order to Black colored and you may Latino homebuyers.

That system increased a great deal more strength into the , whenever Pursue Bank announced it could double their Pursue Homebuyer Offer to $5,000 for licensed homebuyers for the predominantly black colored communities.

Wells Fargo NeighborhoodLift Program – Even offers down-payment and you will house-consumer training having forgivable attention-100 % free loans offered the customer uses up the home for 5 ages. Buyers must over good HUD house training system. Brand new property must be from inside the appointed NeighborhoodLift organizations. The program need customers to do eight period out of home customer training out-of a prescription merchant.

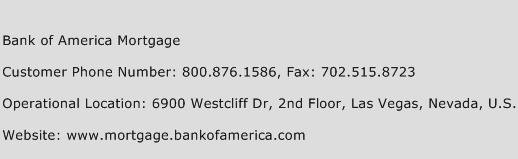

Bank off America’s Downpayment Grant Program – When you look at the , the bank tripled the sensible home ownership step in order to $15 billion. The fresh deposit program lets consumers for 3% per cent from an effective house’s cost one to worthy of as much as $10,000. In more than 260 urban centers and you will areas around the world, the application need zero repayment.

The fresh expansion associated with the initiative is the consequence of extremely confident responses out of clients and you can lovers, said Barkley, just who cards the elevated commitment will assist more than sixty,000 people and family members be home owners by 2025.

Barkley said the application form as a result of possess longer almost $6.9 billion from inside the affordable mortgages and it has helped over twenty seven,000 somebody and you can family members pick a property.

America’s Home Grant System Offers a lender credit as high as $seven,500 which can be used on certain settlement costs. The income will be along side Financial of America’s Down-payment Grant financing to lower homeownership costs.

It include applications that offer advice about closing costs and you may off repayments to help you software that offer lower-interest financing, particularly:

NAREB’s February contract having mortgage company Joined Cover Financial gotten a relationship from LBC Investment to own $fifty billion inside advance payment advice finance having reduced-to-moderate-income people.

The new 3By30 Step – In Cleveland, several houses and municipal proper frontrunners launched a multiple-seasons initiative aimed at the lower Black colored resident price.

You to coalition – this new Black colored Homeownership Collective – boasts 100 teams and people purchased undertaking around three mil the new Black colored residents of the 2030.

Its eight-section package includes: homeownership counseling, deposit recommendations, homes design, borrowing from the bank and you may credit, civil and you can user legal rights, owning a home sustainability and you may income and you can search.

Houses advocacy groups who were assaulting from the disparity getting age state brand new loan company apps try a welcome, if delinquent, collaboration.